Inheriting a house can bring both challenges and rewards. When selling inherited real estate, especially heir property in St. Paul, Minnesota, the process can be complex. This guide addresses and explains the most frequently asked questions and helps overcome the most common barriers to selling inherited property. It also covers the most practical ways to ease the hassles of real estate selling. Focusing on core legal issues, the most common ways to assess real estate, and selling techniques, this guide is intended to help heirs understand the essential aspects of selling it.

Key Highlights

- Understanding the legal and market nuances of inheriting and selling property in Minnesota is crucial for a smooth transaction.

- Resolving title issues, especially when multiple heirs are involved, is essential to prevent disputes and ensure a transparent sale process.

- Properly preparing and valuating an inherited home boosts market appeal and maximizes potential sale value.

- Complying with Minnesota’s legal requirements, including probate, is vital for a legitimate property transfer.

- Navigating emotional ties and effective communication among heirs is key to a successful property sale process.

Understanding Inheriting Property in Minnesota

In Minnesota, inheriting property is not just a home; it is a unique blend of opportunities and obligations that can be exhilarating and challenging. Families, in particular, face these legal, financial, and real-world issues and need to understand Minnesota property laws, including probate and estate taxes, to transfer ownership seamlessly. Unfortunately, unprepared heirs, even heirs with good intentions, will likely face unpredictable delays and complications.

Inconvenient title issues are a frequent frustration with inherited property. Unresolved ownership issues and unserved lien notices can lead to disputes among heirs. This will make selling, refinancing, and managing the property difficult. Resolution will almost certainly require public record research, communication with a title company, and legal resources. Timely and efficient arrangements without a clear title will lead to losing the property’s market value.

Practical concerns are also significant. Real estate an heir inherits, however, might have deferred maintenance, outdated systems, or non-real estate under-occupied, or things that need to be dealt with before the property can be disposed of or occupied. Heirs must analyze the costs of addressing, repairing, or improving the property, prevailing market conditions, and maintenance costs (i.e., taxes and insurance) for the entire duration of the hassles or delays caused by these issues. By combining the legal and the practical, heirs can more effectively work with the property and resolve its legal issues.

K&G Investments helps heirs in Minnesota navigate inherited property, from resolving title issues and probate requirements to managing repairs and preparing homes for sale. We provide expert guidance to ensure a smooth transfer, minimize delays, and maximize value, making the process manageable and rewarding.

Common Challenges in Minnesota Real Estate Inheritance

Minnesota has particularly challenging issues when dealing with inherited property. The state’s inheritance laws are markedly different from its property laws. And real estate issues can become even more complicated because the estate will not likely be settled for some time. Most inherited property will be probated as real estate transactions are incomplete. Painting the property as a whole to avoid probate is not an option. And the process is lengthy because the estate will not be fully closed until the property passes to the final heir in succession. Passing it directly to the next legatee will likely raise complex legal issues.

Minnesota estate laws can pose unique administrative challenges and considerable expense. Even in solvable situations, probate will cause significant time delays in settlement. And each legatee will have the option to decline. The final heir will remain passive and compel the estate administration to run its course. Sometimes, the final heir must be incentivized to work with the estate. It is common to run into ownership issues when property is shared with family, and in these cases, inheritance of property jointly, shared, or multiple ownership of the same estate. The estate may also need to be settled, further complicating estate probate issues.

Analyzing tax implications is also essential. Minnesota does not have a state inheritance tax, but a qualified appraisal of the property’s market value is still necessary for federal tax considerations and potential capital gains. Unsurprisingly, tax implications become more complicated with changing market conditions, and the potential for uncompensated tax liabilities makes such issues the domain of professional tax advisors.

The practical aspects of managing an inherited home should also be considered from a personal perspective. Distant relatives might not know that the home takes time and money to keep. Multiple homes are an emotional and financial burden. Abandoning a home because of an emotional attachment won’t pay off, but being rational helps lessen the emotional impact. Effective tax and estate planning will incorporate your personal interests, reducing friction for an inheritance.

Dealing with Title Issues in Inherited Properties

In Minnesota, inherited property requires careful consideration of its title issues. Such issues can stem from confusion over ownership, disputes amongst heirs, or outstanding liens. Resolving these issues necessitates a good working knowledge of Minnesota real estate, title transfers, and the intricacies of estate law. For a sale or transfer to proceed, a title must be defect-free. Unresolved problems will block or delay a sale or refinancing and result in a sale loss.

The title problem usually necessitates a title search, and the results will determine any potential remediation actions a property owner may take. These will include tax, mortgage, or encumbrances that may be mortgage, tax, or claims. Detecting ownership complications early places heirs in a position to formulate a plan to dispose of the property. Retaining the services of a real estate attorney or a real estate title company in Saint Paul allows the property owner to get answers and avoid any remaining title questions.

If your inheritance comes with a title issue, you must work with county offices and maybe even the probate court. Past county documents will help with ownership questions, and you will need a county transfer to be contested and signed. Liens or disputes will also need to be negotiated on both ends. Unresolved heir disputes may need legal mediation, as will most cases, if you want a marketable title that you can sell. Generally, mediation, negotiation, and structuring title issues will promote dealability and marketability. Offer clients help to understand current title issues and deal with potential future disputes and customer dissatisfaction.

Due to Minnesota’s real estate laws, inheritors can seamlessly sell if title issues are correctly managed and other actions are taken. Newly inherited property in Minnesota should be titled in the seller’s name to ascertain their right to sell it.

Steps to Selling an Inherited Property

Selling inherited property requires guided planning for the associated legal, practical, and emotional complexities. The first thing to consider in this planning is how to make the home appealing to prospective buyers. Inherited properties tend to accumulate belongings and have deferred maintenance or obsolete features. Repairs, cleaning out clutter, and staging the house properly help to increase market interest and draw prospective buyers.

Evaluating the property’s market value is also essential to estimating potential pricing and capital gains taxes for the heirs. Assessing Minnesota law regarding selling my parents’ house also defines the property’s worth. Legally clear ownership through probate allows the title to be transferred and avoids disputes and delays in the sale. Sellers must also fulfill their obligations to prepare documentation and disclosures, including property conditions and tax reports.

Heirs achieve the most efficient, least stressful transaction in the Minnesota real estate market by setting the property and preparing the necessary legal steps for the probate regulations. They achieve this as the value is also maximized.

Contact us today for a personalized offer and expert guidance to help you navigate the sale of your inherited property in Minnesota, making the process smooth, efficient, and stress-free.

Preparing the Home for Sale

To sell an inherited St. Paul, Minnesota, property, the owner, before any sale activities, needs to prepare the home to attract the most potential buyers. This first step involves evaluating the property’s condition. Often, inherited homes come with cluttered belongings, neglected upkeep, and accumulated home maintenance. These elements can be subtractive to prospective buyers, and the owner can relatively easily add value to the sale by divesting clutter and making some necessary home repairs, such as roof and plumbing leaks repairs, and the fixing of plumbing and light fixture issues, and plumbing fixtures.

A realtor’s professional guidance indicates the value of home repairs and upgrades relative to prospective sale value and helps avoid excessive spending. St Paul realtors can assess value and help the owner price the home competitively, considering the home’s condition and market dynamics.

Preparing a home for sale is essential for generating a warm environment for potential buyers, allowing them to imagine making the house their own. This means repositioning furnishings, adopting a more neutral color palette, and concealing personal artifacts and mementos. Finally, the home should be filthy. A professional cleaning should remove cobwebs, clean the windows tightly, and professionally clean the exposed surfaces. An abode eliminates unnecessary hiding places for dust, thus leaving a more positive first impression.

Curb appeal is of the utmost importance when selling a home. Maintaining and grooming the landscape, adding a few seasonally blooming flowers, and painting the front door can achieve this.

Finally, knowledge concerning the St. Paul real estate market enables sellers to time viewings and promote the home thoughtfully and tactically. With careful home presentation, sellers can effectively address buyer reluctance and expedite a seamless, lucrative sale.

Legal Requirements for Selling Property in Minnesota

In Minnesota, selling an inherited property entails specific legal steps to ensure compliance with state laws. As each property must go through probate, the legal process establishes, determines, and champions the rightful owner, then transfers the title to their heirs. Advanced planning is essential, as poorly documented cases may extend the process, and complicated sales involve disputes. Completing all documentation will help avoid disputes and ensure the property is sold smoothly.

Resolving title issues is also very important. By performing a title search, it is possible to ascertain that there are no outstanding liens on the property and that no one has the legal right to prevent the property transfer. Any such issues must be resolved through the appropriate county offices. Property tax implications must also be considered. Inherited properties to sell do not attract an inheritance tax; however, an appreciated capital gains tax will be incurred based on the difference between the selling price and the property’s fair market value at the date of the decedent’s death. Consulting with a Minnesota tax specialist will save you from expensive mistakes.

To maintain transparency and mitigate potential liabilities, sellers must adhere to disclosure obligations and notify purchasers of structural defects and potential environmental risks. Engaging a competent real estate attorney can clarify this process, including drafting and executing documents and negotiating and managing probate. Moreover, knowing local rules, especially in St. Paul, is essential, as city statutes may require renovations or alterations, as well as additional disclosures. These steps provide necessary legal compliance and an efficient process for selling an inherited property in Minnesota.

Financial Considerations in Selling Inherited Property

Selling an inherited property has consequences on one’s finances that can be important, and this is especially true in Minnesota’s highly active real estate market. Knowing the details of capital gains is essential in this regard. Inherited properties usually get a “step-up” based on the value at the time of the decedent’s death, and this can significantly lower the taxable gains in relation to the purchase price.

Having an expert appraisal helps heirs understand the value of an inheritance so they can make well-informed decisions, set reasonable expectations, and fulfill tax obligations. Other than the value, there are net proceeds and tax implications, including federal and likely state capital gains and deductions and/or expenses netting out of the proceeds.

Thinking ahead, like sequencing the sale, dealing with liens, and minor improvements to the property, can enhance what heirs get out of the inheritance. Heirs can resolve the complexities of inherited property to achieve a sale that maximizes value while minimizing unexpected costs.

Impact of Capital Gains on Inherited Home Sales

Understanding capital gains taxes on the sale of inherited property in Minnesota is essential. A capital gains tax is charged on the profit made on the sale, the sale price minus the property value at the time of the decedent’s death, usually at fair market value. A step-up in basis generally reduces the capital gains compared to the original purchase price and, in turn, the tax liability. Appraisals will be needed to determine the basis, and a professional appraiser should be utilized for the estate to remit the correct tax.

Capital gains are best understood with the help of federal guidelines. Minnesota residents selling an inherited home must also comply with the federal guidelines. The duration of ownership of the home affects the tax. Selling the house within a year of inheritance results in a short-term capital gain, which incurs higher tax rates than long-term capital gains. Estate beneficiaries must work with tax advisors to optimize outcomes, as much planning can be done.

Financial considerations go beyond taxes. Ongoing costs such as property taxes, maintenance, and outstanding debts or liens can influence whether selling is more advantageous than retaining the property. Balancing immediate financial relief with potential market appreciation affects capital gains exposure and profitability.

Understanding possible exemptions and deductions is equally essential. For example, if the heir occupied and lived in the inherited house, they may be able to claim a primary residence exclusion, which would help decrease taxable income. Considering these potential legal complexities enables sellers to optimize their tax obligations management. Such attention to detail makes the preparation so crucial to the sellers in Minnesota when dealing with inherited property and the capital gains involved.

Evaluating the Property’s Market Value

Determining the market value of an inherited home is a crucial step in selling estate property. Minnesota’s real estate market, especially in urban areas like Saint Paul, fluctuates frequently, affecting property valuations. A precise assessment helps set a competitive asking price, informs potential capital gains or estate tax considerations, and allows heirs to evaluate offers from cash house buyers in St. Paul and other Minnesota cities. This process typically involves analyzing market trends, comparable sales, and unique features of the inherited home, often through a comparative market analysis (CMA).

A Comparative Market Analysis assesses recently sold properties, considering size, age, and condition, to obtain a realistic range. A certified appraiser’s unbiased perspective will satisfy tax and probate court requirements. With a market professional’s input, heirs will understand where to place the optimal sale price that the actual market value will endorse and maximize the estate’s value.

Economics, developments within a neighborhood, and accessibility to specific amenities comprise local facets that affect market value. Market awareness helps avoid the pitfalls of poor pricing: overpricing drives buyers away, while underpricing results in lost revenue. Having intervals for reassessing selling price parameters is beneficial because shifts in market conditions happen fast and often.

The condition of inherited houses is also an essential factor that we will consider. Houses that were inherited may need upgrades and repairs to meet the current market demands. Evaluating the worth of needed repairs, rendering the building sound, enhancing the mechanical systems, and providing some curb appeal or landscaping will likely improve the marketability and justify a higher asking price.

Resolving title issues or liens clarifies legal standing, protecting against adverse financial consequences. With balanced professional assistance, thorough property appraisal, and market knowledge, heirs can efficiently sell a house in Minnesota, maximizing returns and adhering to prevailing market conditions.

Tips for a Successful Property Sale

In Minnesota, successfully selling your inherited property requires comprehensive planning and knowledge of the real estate market in the area. Determine the ideal audience for the neighborhood, the property type, and special features, since each market will have its unique audience. Providing high-quality materials through professional photography, elaborating on your advertising, and targeting advertising will significantly improve your selling prospects. Simple renovations and alterations to the property, along with staging and decluttering, will assist potential buyers in picturing themselves in the property, which will almost always yield quicker offers and improve your negotiating position. Working with an experienced realtor will assist with developing your selling price and provide insight and guidance on your area’s market and buyer trends. It will reinforce the strategies you have created to sell your property.

The emotional component of selling a house that is part of the family is no less critical. Inherited property often includes family homes and can sit heavily on the conscience. Disenfranchised family members and differing views will always lead to conflict and form the basis of the family blame; therefore, communication is essential. Prioritizing these aspects will allow the seller to make emotionally sound and financially rational decisions. The integration of these principles will improve the selling experience at the time of the family’s emotional burden.

| Key Areas | Strategies | Benefits | Professional Assistance |

|---|---|---|---|

| Buyer Attraction | High-quality photos | Enhanced market visibility and interest | Real Estate Agent |

| Curb Appeal | Minor renovations | Increased property value and buyer interest | Contractor |

| Virtual Tours & Social Media | Leveraging virtual tours | Wider audience reach and convenience for interested buyers | Photographer/Videographer |

| Pricing Strategy | Competitive pricing | Attracts more offers and expedites the selling process | Real Estate Agent |

| Emotional Transition | Family discussions | Ensures emotional preparedness and smooth transition | Family Counselor/Legal Advisor |

This table outlines essential strategies and considerations for effectively managing the financial and emotional aspects of selling an inherited property in Minnesota.

How to Attract Buyers for Your Minnesota House

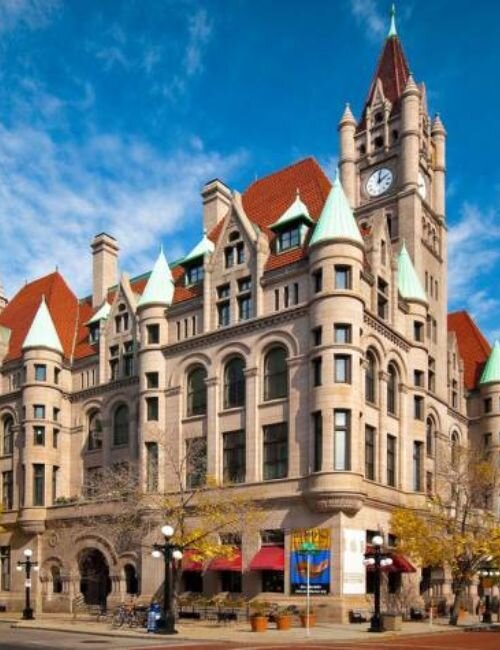

The importance of enticing potential buyers for an inherited property in Minnesota’s competitive real estate market cannot be overstated. Understanding the area dynamics of the St. Paul marketplace makes it easier to identify the audience to optimize selling potential. Begin by creating an eye-catching listing on Zillow and Realtor.com. Blooming the listing with gorgeous pictures and rich descriptions of the property’s distinctive features, like period architecture, custom woodwork, and recently modernized kitchens, will excite the interests of buyers in historic homes and those in the market for contemporary homes.

Texas buyers are very practical, and their expectations will help determine the capital improvements to be made. Improvements to curb appeal make a strong, positive first impression on potential buyers. Improving the curb appeal, like freshened landscaping, a newly painted front door, clean walkways, and attended exteriors, is very inexpensive but dramatically increases the home’s attractiveness.

Partnering with a knowledgeable local real estate agent can make a significant difference. An experienced agent can guide you on pricing strategies, manage showings, and position your property competitively in the market. Overpricing may deter potential buyers, while underpricing could undervalue your property, so professional guidance helps strike the right balance.

Expanding your marketing reach is also important. Virtual tours, high-definition videos, and targeted social media promotion can attract out-of-state or international buyers and Minnesota cash buyers actively seeking properties. Virtual tours allow prospects to explore your home remotely, while focused social media campaigns connect your listing with likely interested buyers in the St. Paul area and beyond. Together, these strategies can help your inherited property sell efficiently and for the best price.

Navigating the Emotional Aspects of Selling a Home

Selling an inherited home is both a financial decision and an emotional journey. These properties often carry sentimental value, housing memories that span generations. Acknowledging this emotional significance and engaging in open discussions with family members is essential, especially when multiple heirs are involved and are connected to the home.

The process can bring up memories of the decedent, so creating a supportive environment is essential. Consider a family gathering to celebrate shared memories before listing the property. This can provide closure and help frame the sale positively, emphasizing that selling the home transitions the family’s history rather than ending it.

Having a strategic plan can also reduce stress. Working with a trusted real estate agent or financial advisor ensures the technical aspects of selling are handled professionally. Agents can mediate negotiations, while legal professionals can address probate or sale complications, ensuring all heirs understand their rights—fundamental in Minnesota, where specific legal requirements apply.

Finally, focus on the positives. Selling an inherited property offers financial opportunities for reinvestment or use to meet family needs. Honoring the home’s legacy while allowing new owners to create memories helps all parties transition with closure and optimism. In St. Paul, Minnesota, navigating heir property sales requires balancing legal complexities and family dynamics, with clear communication and expert guidance key to a smooth and equitable process.

FAQs:

What are the legal requirements for selling inherited property in Minnesota?

Selling inherited property in Minnesota requires going through probate, the legal process for managing the decedent’s estate. Establishing rightful ownership is crucial and requires thorough documentation. A title search should also be conducted to resolve potential liens or legal hindrances.

How can title issues be resolved when selling an inherited property?

Title issues can be addressed by obtaining a title search to identify existing claims or debt. Resolving these issues may involve negotiation with lienholders or mediation among heirs, requiring coordinated efforts with local county offices and possibly legal intervention.

What are the tax implications of selling inherited property in Minnesota?

While Minnesota does not impose a state inheritance tax, selling inherited property may incur capital gains tax based on the difference between the sale price and the fair market value at the time of inheritance. Consulting a tax professional is advised to navigate potential tax obligations.

How can the market value of an inherited home be determined?

Determining the market value of an inherited home involves conducting a comparative market analysis (CMA), assessing similar properties, and consulting a certified appraiser. These steps ensure an accurate valuation for competitive pricing and comply with probate requirements.

How can heirs manage emotional ties when selling an inherited home?

To manage emotional ties, open communication among heirs is essential, acknowledging everyone’s feelings and opinions. Holding a family gathering to celebrate memories can provide closure. Strategizing with professional real estate agents and legal advisors can also reduce emotional stress by handling technical aspects of the sale.

Do you need to sell your inherited house? Sell it quickly, avoid costly repairs, or prefer a hassle-free sale. K&G Investments is here to help. We offer fair cash offers, handle all the details, and make the process seamless. Ready to sell or have questions? Call us at (612) 400-8070 for a no-obligation offer. Get started today!

Helpful St. Paul Blog Articles

- Can Heir Property Be Sold in St. Paul, MN

- How Long After an Appraisal Can You Close in St. Paul, MN

- How to Sell a House in Bankruptcy in St. Paul, MN

- Selling My Parents’ House in St Paul, MN

- Sale Of A Rental Property in St. Paul, MN

- Selling A House With Termite Damage in St. Paul, MN

- Selling A House To A Family Member in St. Paul, MN

- Sell a House in St. Paul, MN, When Relocating

- Selling Home with Reverse Mortgage in Saint Paul, MN

- Selling Your House to a Relocation Company in Saint Paul, MN

- Can an Estate Administrator Sell Property in Saint Paul, MN

- How to Sell a House When You Are Behind on Payments in St. Paul, MN