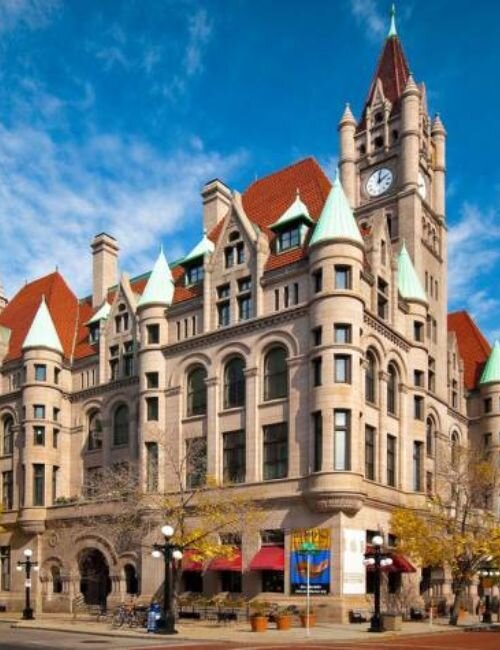

Estate administrators in Saint Paul, MN, must understand estate management law when selling a property. Administrators must follow Minnesota’s probate laws to obtain the authority to sell. To distribute assets properly, direct inheritance and wills must follow state guidelines. In Minnesota, K&G Investments assists estate administrators in selling properties legally and efficiently.

Brief Overview

Selling a property in Saint Paul, MN, involves navigating Minnesota probate laws to ensure compliance with estate laws. Selling assets requires estate administrators to get judicial approval to safeguard the interests of the beneficiaries. Complaining about possible probate, formal or informal, is tedious and requires a lot of planning and communication with all involved. Estate value can be preserved, and the wishes of the deceased can be honored through probate understanding and legal procedure compliance. Help cash home buyers in Saint Paul and the surrounding areas to facilitate the sale of estate property.

Key Highlights

- Minnesota probate laws and property sales must be adhered to by executors.

- Important processes include assessing and notifying beneficiaries and paying debts.

- The will must be adhered to, and court approval is needed for sales of estate property.

- Especially when the estate contains valuable real estate, knowing when probate is required is vital.

- To protect and ensure the legality of the beneficiaries, the probate court supervises the sale of real property.

Understanding the Role of an Estate Administrator in Minnesota

In Minnesota, an estate administrator oversees the estate of a deceased person. Appointed administrators are typically named in the will as executors. Estate administrators in Minnesota manage and distribute the deceased’s assets in accordance with Minnesota estate law. Estate administrators have the authority to control assets for the benefit of the beneficiaries and, in certain situations, sell property. Estate administrators have distinct property-selling responsibilities that must be understood in order to navigate the process effectively.

Key Responsibilities of a Personal Representative

In Minnesota, after someone dies, a personal representative or an estate administrator is responsible for managing that person’s estate. This includes identifying, collecting, and valuing estate assets, paying debts, and distributing estate property according to the will or applicable probate laws. Personal representatives must communicate with the will’s beneficiaries, obtain court approval for certain real estate transactions, and address unpayable liens or death taxes. Closing these transactions is a part of record-keeping, a transparent process to avoid estate settlement disputes. Minnesota estate personal representatives comply with the law by coordinating with estate appraisers, estate planning attorneys, and other professionals to manage the probate value of the estate and lawfully maintain the interests of the beneficiaries.

To further understand the primary responsibilities of personal representatives, the following is a list of other duties to perform during Minnesota estate administration:

- Conduct routine estate appraisals, settlements, and distributions to comply with Minnesota probate law.

- Communicate freely with probate beneficiaries.

- For each probate period, obtain and implement the attorney’s advice.

- Hire an accountant to avoid complex estate divestment issues.

- Watch and manage time to avoid estate administration delays.

- Become knowledgeable about current laws and municipal regulations that govern the sale of real estate.

These duties of personal representatives improve and define the administration of their estates.

Authority to Sell Property in Minnesota

In the state of Minnesota, estate administrators’ power over the sale of property comes from their personal representative status and from the estate being executed as the decedent wishes, along with the estate being executed as the law requires. However, this power is almost always contingent upon court approval so that the sale is in compliance with the settlement of the estate or the instructions of the will. Additionally, administrators are constrained by the will and must work with an appraiser to determine the fair market value of the property and address any liens or encumbrances on the property prior to sale.

Primarily, the most important factor is keeping estate beneficiaries up to date during the entire process to minimize the risk of estate litigation. Under Minnesota State Probate law, the sale of the property divides the proceeds to dispose of the estate’s creditors or to divide the estate among the heirs. Therefore, sustained estate litigation avoidance to the fullest extent requires proper procedure, planning, and communication to minimize the risk of estate litigation in the sale of property.

Navigating the Probate Process in Minnesota

Probate in Minnesota is complicated, but it’s necessary to manage and distribute an estate. Estate administrators must know when probate is needed and distinguish between informal and formal probate processes. Knowing these details helps ensure legal compliance and smooth asset transfers, especially when selling property in Saint Paul. Understanding these processes helps estate administrators manage responsibilities, giving beneficiaries peace of mind and complying with Minnesota law. Discover how We Buy Houses in Minnesota and nearby cities can help sell estate properties.

When Is Minnesota Probate Required for Selling Property?

In Minnesota, probate is needed to validate a will or determine heirship, especially for estates over $75,000 or real estate in the deceased’s name. It legalizes property transfers, protects beneficiaries and creditors, and lets the estate administrator handle liens, mortgages, and title transfers. Probate court oversight ensures accountability, settles heir disputes, and guides testate and intestate estate sales. Estate administrators in Saint Paul must understand these requirements to efficiently navigate the process, facilitate lawful property sales, and ensure fair asset distribution under Minnesota probate law.

| Probate Requirement | Key Considerations | Estate Administrator Responsibilities | Formal vs. Informal Probate |

|---|---|---|---|

| Determining Jurisdiction | Establish court authority based on the deceased’s residence or property location | Identify and file in the correct county of jurisdiction | Formal requires court supervision; informal allows more flexibility |

| Petition Filing | Initiate process by submitting the necessary legal documents to the probate court | Prepare and file petitions accurately and timely | Formal involves a hearing; informal typically does not |

| Asset Inventory | Comprehensive cataloging of the decedent’s assets, including value assessment | Compile and submit an inventory of all assets and liabilities | Both require inventory; formal has stricter reporting requirements |

| Notice to Creditors | Legally notify creditors to present claims within a specified period | Publish notice and manage creditor claims accordingly | Formal requires detailed creditor engagement; informal is less stringent |

This table illustrates Minnesota’s complex probate requirements and estate administrators’ key decisions and roles.

Differences Between Informal Probate and Formal Probate

Minnesota estate administrators should be aware of the various types of probate and their application to estate matters, including property transactions. Informal probate is less expensive and faster than formal probate and works best with cooperative heirs and uncontested estates. Administrators can reduce the amount of court supervision they have while managing the sale of an estate’s assets. This is particularly useful for relatively simple cases, such as the sale of a piece of real estate in Saint Paul.

Formal probate, on the other hand, involves the courts much more and is more prevalent in the case of wills that are contested or estates that are more complicated. There may be several court approvals needed for the sale of an estate’s assets in formal probate to ensure that the legal requirements are met and the interests of the heirs are protected. The right process is a better way for estate administrators to avoid or minimize the tasks involved in the management of the estate.

Selling Property During Probate in Saint Paul

Selling estate property during probate in Saint Paul, Minnesota, is legally and practically complicated. Minnesota has its own unique challenges when it comes to selling estate property and navigating the probate system. This blog analyzes the challenges of selling estate property during probate and the impact of probate court proceedings on the sales. With a greater understanding of these challenges, estate administrators can improve their management and protect the interests of the beneficiaries while staying within the bounds of Minnesota probate law.

Challenges of Selling Property in Probate

Selling real estate in probate in Saint Paul is time-consuming and involves more than just the legal aspect. Estate processors take the time to obtain feedback from the courts due to the fact that they go over the probate laws of Minnesota to ensure that the sale is in the best interests of the estate and the beneficiaries. To proceed with the sale, there are probate filings and legal documents that must be completed and a property value appraisal. Further complicating the process is the fact that there are liens, mortgages, or taxes that are owed that must be handled beforehand.

In order to meet the expectations of the beneficiaries and to diffuse the eruption of their frustrations, the administrators must keep constructive dialogue and be open about the process at all stages. Moreover, the timing, condition of the market, and the real estate can complicate the sale further. With enough time and proper legal measures, the administrators can overcome the difficulties and complete a timely sale of the property.

How Probate Court Influences Property Sales

In Saint Paul, the probate court is involved in the sale of estates to ensure that sales are in the best interests of the beneficiaries. Before selling a property, the estate administrator must obtain a court order, and the sale must be justified in the petition as being necessary to resolve a claim, distribute the property equitably, or comply with the terms of the will. The court controls the terms of the sale and the sale price and will order the sale to be set at a value determined by a court-appointed real estate broker so that there will be no disputes or underpricing of the property.

There are also probate court procedures that impact when and how the property may be sold. Sometimes these factors require the estate administrator to manage competing court and market timelines. The probate court also provides mediation in intestate estates and disputes among beneficiaries to ensure fairness. Following the court’s instructions gives the estate administrator a measure of protection and helps him deal with the complexities of Minnesota probate law as it relates to selling estate property.

In Saint Paul, MN, administrators must understand legal obligations and the probate process to sell a property. Administrators can manage estate assets by using court authority and staying informed and organized. Working with local property law and probate experts can simplify the transaction. To ensure a smooth property sale and confidence in estate management, contact K&G Investments for expert guidance.

Do you need to sell a property as an estate administrator in Saint Paul, MN? Whether you want a quick sale, wish to avoid costly repairs, or need a hassle-free process, K&G Investments is here to help. We provide fair cash offers, manage all the details, and make selling as straightforward as possible. Have questions about your authority to sell or the estate process? Call us at (612) 400-8070 for a no-obligation consultation. Get started today!

FAQs

What do estate administrators do in Saint Paul, MN?

In the state of Minnesota, probate laws require estate administrators to process, manage, and distribute the deceased’s estate, which includes valuation of the assets, settlement of debts, and notification to the beneficiaries.

When is probate necessary in Minnesota?

If the estate is valued at over $75,000 or if the estate is solely owned by the deceased, probate is necessary. It is done to protect creditors and beneficiaries.

Is court approval needed for an estate property sale in Saint Paul?

In order to protect the estate and comply with the Minnesota probate laws, court approval is generally needed for estate property sales.

What are the differences between formal and informal probate in Minnesota?

In the case of informal probate, the estate is handled much faster and is at a lower cost. Also, there is less supervision from the court. In formal probate, the judge is involved in resolving issues and disputes and is also more involved in the case for complex estates.

Can estate administrators sell property freely?

An estate administrator can facilitate the sale of a property, as long as the probate regulations are adhered to, the beneficiaries are communicated with, and local property laws are consulted.

Helpful St. Paul Blog Articles

- Can Heir Property Be Sold in St. Paul, MN

- How Long After an Appraisal Can You Close in St. Paul, MN

- How to Sell a House in Bankruptcy in St. Paul, MN

- Selling My Parents’ House in St Paul, MN

- Sale Of A Rental Property in St. Paul, MN

- Selling A House With Termite Damage in St. Paul, MN

- Selling A House To A Family Member in St. Paul, MN

- Sell a House in St. Paul, MN, When Relocating

- Selling Home with Reverse Mortgage in Saint Paul, MN

- Selling Your House to a Relocation Company in Saint Paul, MN

- Can an Estate Administrator Sell Property in Saint Paul, MN

- How to Sell a House When You Are Behind on Payments in St. Paul, MN