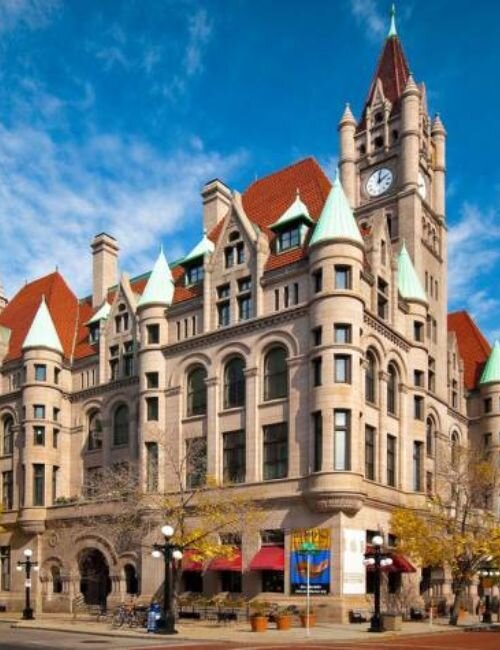

Selling an inherited house in St Paul, MN, involves emotional and financial complexities. Whether balancing taxes or getting the house ready, knowing the complexities of the real estate market in Minnesota is important. This guide tries to offer important information to help ease the process and provide practical advice and professional strategies. Moving from St. Paul’s sellers to the guide’s final steps of assessing the value of the property and closing the sale, the guide focuses on managing the process in an efficient manner. Learn how to make negotiation, curb appeal, and transaction processes easier in an honorable manner with the help of K&G Investments, your trusted partner in navigating the Minnesota real estate market.

Understanding the Process of Selling Inherited Property in Minnesota

Inheriting property can be a daunting experience, especially in places like Saint Paul, where market conditions can be tricky. Each step in the process demands a unique blend of planning and thoughtful implementation; the emotional weight of the task should not be overlooked. This segment walks you through the first steps of managing an inherited property and the challenges you may encounter in preparing the home for sale. These observations seek to provide a guiding hand for the effective and respectful selling of the home to honor the memory of the deceased. The goal is to help make the experience of dealing with an inherited estate as seamless as possible.

Initial Steps After Receiving an Inherited Property

Once a property is inherited in Minnesota, there is a need for an organized plan, ensuring an easy transition and, later, a sale. An initial assessment of the estate’s condition and the finances is important. Identify any mortgages, any unpaid taxes, and any maintenance costs that may be associated with the property. Taking a full inventory will clarify your understanding of the estate, both from a financial and physical perspective. This is even more important in the case of a family estate. It will be necessary, though sometimes daunting, emotionally, to disengage from over-sentimentality for the sake of practical decision-making that plans for the future. This will honor the memory of the family member for the remainder of the estate value.

Concerning the legal and market implications of the inheritance, the next step is to consider the legal implications. In Minnesota, the legal ownership of the estate must be established prior to proceeding to manage the estate. After determining who will manage the estate, the deceased’s ownership of real properties will be determined. Subsequently, the estate will require a professional appraisal to determine the property’s market value. This is essential because it provides a realistic framework within which a fair listing price can be established. In this case, also consider the property. Order and complete repairs and updates to make it more appealing. By performing these activities, you will be in a better position to manage the legal, emotional, and financial aspects of the property, which will result in a more positive outcome when it is time to sell the property.

Challenges in Selling Inherited Property

Unloading a property that has been left to you can come with emotional and practical challenges that make the job seemingly daunting. Heirs are legally expected to pay property taxes, maintenance costs, and utilities, which can become a burden while waiting for the property to sell. In Saint Paul, and many other places for that matter, the property may not sell for the price you hoped for, and the length of time for it to sell can be extended. There are also emotional challenges to be considered; it can be hard to rationalize a price to sell a family home, even for the practical value costs. Emotional value can make it even harder for heirs to rationalize a price to sell and override offers. Emotional and practical considerations need to be balanced, and communication becomes necessary for family members.

Complications relating to the law and the logistics can take on more forms than initially anticipated. When heirs disagree over the disposition of the property, the equitable distribution of the proceeds, or the true intent of the deceased, indecision and litigation can ensue. One must also take care to understand Minnesota real estate law, the probate process, and the local market to avoid avoidable mistakes. Experienced real estate and legal professionals can help lessen the litigation and streamline the sale. The seller will deal with litigation, emotions, and the financial costs of settling the legal risks, while the seller continues selling the property and ensuring its legacy.

Navigating the Probate Process in Minnesota

In Minnesota, most notably St. Paul, knowing the intricacies of the probate process is important for selling an inherited property. This part examines the influences of probate on property sales, focusing on the relevant legal, financial, and procedural issues. Understanding the inheritance law of Minnesota is crucial, as it governs how estates are distributed, taxes are applied, and ownership transfers occur after a loved one’s passing. Streamlining these issues allows for compliance with the estate and probate laws of Minnesota, avoiding undue difficulty in preparing the estate for sale. An effective approach balances the fulfillment of market expectations with the desire to respect your parents’ legacy.

How the Probate Process Affects Property Sales

How quickly and smoothly inherited property can be sold in Minnesota is largely determined by the probate process. Probate is when the courts validate a deceased party’s will and distribute the deceased’s assets, including real property. The property may not be sold until the probate court orders it, which can take several months or more, depending on the intricacies of the estate and disagreements among the heirs. The estate will bear costs in the interim: maintenance, property tax, and insurance, so having a plan in place is critical. Careful collaboration with a probate attorney familiar with Minnesota’s inter-county probate rules can greatly assist in minimizing time-consuming problems. An attorney familiar with St. Paul would be particularly helpful.

Probate proceedings establish who legally sells inherited property. Generally, the executor or personal representative specified in the will is responsible for selling a house in probate, but the court appoints an administrator to take charge of the property if the will is absent. Each of these parties is responsible for ensuring that the property is sold for its fair market value and may be required to obtain court approval for the sale. Because buyers need proof of the sale’s legality and assurance of an unencumbered title, sellers should be advised to provide documentation, such as the grant of probate. It is essential for sellers to understand the impact of probate on property sales, coupled with prudent communication with all stakeholders, to help avert unnecessary woes, legal compliance, and the completion of the sale to the estate’s honor.

| Stage | Description | Actions Required | Timeframe | Key Consideration |

|---|---|---|---|---|

| Filing the Petition | Initiating the probate by submitting the necessary documents to the court. | Prepare and file the petition for probate, locate the will, and gather relevant documents. | 2-4 weeks | Ensure all paperwork is accurate and complete to avoid delays. |

| Notification | Notifying heirs, creditors, and interested parties. | Publish a notice in a local newspaper and mail notices to identified parties. | 4-6 weeks | Adhere to legal deadlines for notification to prevent contested issues. |

| Asset Inventory | Compiling a comprehensive list of the estate’s assets and debts. | Enlist appraisers if necessary and submit inventory to the court. | 1-3 months | Ensure thoroughness and accuracy to uphold fiduciary responsibility. |

| Settlement of Debts | Paying off the estate’s debts and taxes from available assets. | Identify claims, validate debts, and process payments. | Varies | Prioritize debts to maintain solvency and legal obligations. |

| Distribution | Transferring remaining assets to the rightful beneficiaries. | Distribute assets as per the will or state’s intestacy laws if no will exists. | Final stage | Comply with court directives to finalize the process. |

The table outlines critical stages in Minnesota’s probate process, emphasizing the procedural demands and timelines involved. It reflects on how careful preparation and adherence to legal criteria are pivotal for a streamlined progression of probate, highlighting key actions required at each stage to ensure a successful resolution.

Legal and Financial Considerations for Inherited Property

Managing inherited property involves navigating both legal and financial landscapes to ensure smooth transitions and optimal outcomes. It’s essential to understand estate and property taxes, as they can significantly impact the financial standing of the estate. Moreover, comprehending the legal intricacies involved in property transfer will provide clarity and prevent potential disputes among heirs. These considerations affect not only the selling process but also the overall management of the inherited estate within Minnesota’s specific legal context. For those looking to simplify the process, you can also sell your home for cash in St. Paul or nearby cities, providing a quicker and more convenient solution while avoiding the complexities of traditional listings.

Impact of Estate Taxes and Property Taxes

Knowing how estate taxes and property taxes work is valuable when managing inherited property in Minnesota because there are unique estate management financial implications. Estate taxes are taxes on the transfer of the estate of a deceased individual. They can diminish the net worth of the property inherited. In Minnesota, estate taxes are applied to estates exceeding a particular threshold. Estate taxes can diminish the value of an inheritance. In this case, heirs ought to determine if their inherited estate is likely to fall in the taxable estate range and plan to manage taxes appropriately.

Property taxes are also critical. These taxes continue to be charged on the inherited property during the probate process, and poor management can result in penalties and foreclosure. Knowing the annual property tax requirements and, equally as important, the probate taxes is necessary for the estate to maintain its worth. This is especially the case for the estate to avoid interest and penalties that will add to the estate liabilities.

To navigate these taxes efficiently, working with a tax advisor who specializes in Minnesota tax law may be of some assistance. They can suggest some deductions, exemptions, or credits the estate may qualify for, potentially decreasing the estate’s tax liability. These specialists can also help clients comply with the timing of the filing of estate and property taxes, helping clients avoid costly penalties and helping them manage the estate. This proactive approach eases the burden of the estate transition and allows heirs to manage other immediate priorities, like prepping the property for an expected sale in Saint Paul. This focus improves the prospects of a successful sale in the Saint Paul market.

Legal Aspects of Property Transfer

In Minnesota, the process of legally transferring inherited property needs to be meticulous to avoid any problems with Minnesota state laws during a change of ownership. This process starts with the probate of the will and the identification of heirs based on the will and Minnesota state laws for inheritance, including determining who the heirs are. Once the heirs are established, the property owner will need to change the title with a deed, and the type of deed will determine the title guarantees. Once a title deed has been drafted, it needs to be recorded with the county recorder’s office for a change in ownership to be recorded.

Legal counsel also helps families in Minnesota draft proper inter-family agreements that outline the share entitlement ownership, the commanded action, and the control of resources to reduce disputes and legally potent estate shrinkage due to estate depletion. Disputes in deed preparation and estate-associated liens will delay and legally nullify the estate transfer. With this in mind, estate property law helps in compliance to legally meet the distinctions of ownership during disputes and refine the ambiguous overlapping of estate layer stakeholders, which may assist in the estate to retain real estate.

Effective Strategies for Selling Property in Minnesota

Minnesota inherited home sales must acknowledge legal requirements and consider emotional value and price determination. Streamlined approaches to valuably expedite sales are priceless. Valuable sales require sound study and appreciation of local property markets. The price of emotional sales is reliance on practical study. In some cases, selling the inherited home to a family member can simplify the process but also requires careful handling to ensure fair valuation, compliance with tax regulations, and transparency among heirs. The rest of this text looks at streamlining inherited home sales while covering and paying tribute to the familial legacy maintained during the listing and closing processes.

Tips for Selling an Inherited House Quickly

To sell a house that has been inherited quickly in Minnesota, one needs to prepare, develop a pricing strategy, and market effectively. When trying to draw in buyers, first, focus on making the house look more attractive by undertaking a thorough clean and repair, then add a few inexpensive improvements. Having the house up to safety standards and looking well cared for will help market the property. In a market as active as Saint Paul, a well put-together house will get more offers, more quickly. Equally as important is the pricing strategy, set in collaboration with a local real estate professional, which will definitely involve a comparative market analysis. The goal here is to set a price that will attract buyers’ attention in a flash without undervaluing the house.

Effective marketing strategies are necessary for expediting the sale. Attention-grabbing property descriptions, virtual tours, and high-quality, creative photographs focus the seller’s attention on the property, fostering the seller’s emotional attachment to the home. Once an emotional connection is made, faster offers become a likelihood. To streamline the sale, gather all pertinent documents—financial and legal, deed, will, appraisal reports, etc.—before the property is listed. This preparation will avoid administrative delays when a prospective buyer is ready to proceed. The combination of powerful presentation, appropriate pricing, and proactive preparation will result in a faster and more efficient sale, all while preserving the property’s legacy.

Evaluating Financial Options for Selling Your Property

The financial implications of selling an inherited property in Saint Paul, Minnesota, can be complex. Selling an inherited property in Saint Paul, Minnesota, can be complex and, from a financial standpoint, needs to be understood properly. Whether the focus is on optimizing financing and minimizing capital gains taxes, priorities can be aligned to facilitate a better financial outcome. This part of the text focuses on the financial impact of selling an inherited property. The goals of the text include how capital gains taxes can impact profitability, the value of flat fee services, and why home valuation is critical in the current market. For those seeking a faster and simpler route, you can also sell your home for cash in Maplewood or nearby cities, allowing you to avoid traditional market delays and streamline the financial process.

Understanding the Financial Impact of Selling an Inherited Property

This can considerably impact your finances, especially in the Twin Cities, where properties andestate taxes can considerably impact your finances, especially in the Twin Cities, where properties and estate taxes can vary considerably. When selling an inherited property, estate taxes and capital gains taxes primarily consider the property’s purchase price, the property’s value at the time of inheritance, and the selling price of the property. For this reason, obtaining a professional home valuation to minimize the chances of overpaying taxes is important. Local appraisers and tax advisors, who understand the Minnesota appraisers and tax advisors, who understand the Minnesota tax law, will offer the best assistance to minimize tax liabilities and help you maximize net value from the sale. Familiarity with the real estate market in the area, especially Saint Paul or the surrounding area, will help determine the selling period to optimize financial returns.

Moreover, the selling process can be made more efficient through the preparation of a strategic financial plan. This can be accomplished through the use of flat fee services, which will alleviate unpredictable costs and help simplify the budgeting process as opposed to traditional commission services. On the other hand, short-term loans and lines of credit can help ease the financial burden of funding necessary property repairs that increase a property’s appeal. To avoid trouble, keep financial records, work with a tax advisor, and keep abreast of the evolving tax laws in Minnesota. In the end, understanding the tax implications, market conditions, and the property’s financial value will enable the seamless inheritance to sale transition process while protecting the legacy of the estate, and the financial gains to be made.

Yet selling a house that has been inherited in St Paul, MN, may be complex. When the market and legal landscape are properly understood and the necessary local professionals are gained, the process becomes manageable and fulfilling. This honors your parents’ legacy and makes sure the value of their investment is protected. There are financial and community resources that are supportive and will be of help in increasing the return. Move forward with a positive mindset to increase the level of trust and embrace the process. This will ease the transition of the home into the next phase of life, having been planned for in advance.

FAQs

What are the initial steps for selling an inherited property in St Paul, MN?

To facilitate the process of property preparation for sale, one must first conduct a full property inventory, analyze existing liabilities, and measure the emotional worth of the property.

Why is the probate process significant when selling inherited property in Minnesota?

The probate process assigns executors, identifies beneficiaries, and must–as a matter of law–be fulfilled prior to transferring ownership of a property. It sets timelines and guarantees the distribution of the property in accordance with the decedent’s will.

How can I determine the market value of an inherited house in St Paul?

Obtaining professional appraisals assists in determining the current market value. Knowing the market value helps set a true value aligned with market conditions in Minnesota, which increases the potential for a successful sale.

What challenges might arise when maintaining an inherited property before selling?

Household upkeep entails ongoing obligations like taxes, utilities, and maintenance, which are costly and can become a burden. Concerning heirs, emotional attachments and possible legal conflicts can complicate matters even further, thus requiring additional attention.

What strategies can expedite the sale of an inherited property?

Boosting a property’s attractiveness through cleaning and repairs, pricing competitively, and endorsing effectively are fundamental. Well-organized control of the legal and financial paperwork is also crucial for the rapid execution of the sale.

Do you need to sell your parents’ house? Whether you’re handling an inheritance, managing an estate, or simply looking to sell quickly without the stress of repairs, K&G Investments is here to help. We offer fair cash offers, take care of all the details, and make the entire process simple and stress-free. Ready to sell or have questions? Contact us at (612) 400-8070 for a no-obligation cash offer and let us help you through this important transition. Get started today!

Helpful St. Paul Blog Articles

- Can Heir Property Be Sold in St. Paul, MN

- How Long After an Appraisal Can You Close in St. Paul, MN

- How to Sell a House in Bankruptcy in St. Paul, MN

- Selling My Parents’ House in St Paul, MN

- Sale Of A Rental Property in St. Paul, MN

- Selling A House With Termite Damage in St. Paul, MN

- Selling A House To A Family Member in St. Paul, MN

- Sell a House in St. Paul, MN, When Relocating

- Selling Home with Reverse Mortgage in Saint Paul, MN

- Selling Your House to a Relocation Company in Saint Paul, MN

- Can an Estate Administrator Sell Property in Saint Paul, MN

- How to Sell a House When You Are Behind on Payments in St. Paul, MN