Understanding Foreclosure Processes in the Twin Cities Real Estate Market

If you’re considering selling your house because you’re being squeezed on mortgage payments, learning about the foreclosure process in the Twin Cities real estate market is critical. Foreclosure is the repossession and property sale of a homeowner by the lending institution due to failure to make mortgage payments.

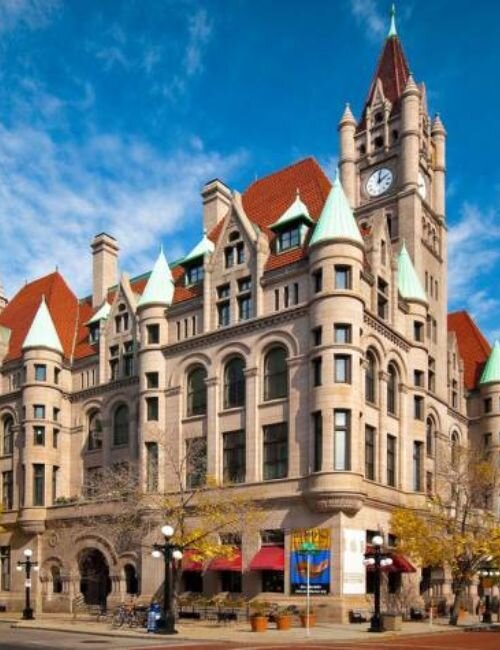

North Star cities such as Minneapolis and St. Paul are in Minnesota, which means almost all of the properties in the area are subject to foreclosure by either judicial or non-judicial means based on the mortgage contract.

Homeowners generally receive a pre-foreclosure notice after missing several payments. They are notified so that they can consider options such as modification or short sale before the lender’s formal actions. Actively selling your home during this time can save you from having your credit score damaged for years.

So it is crucial to know the timeliness and details of the legal rights. There are instances when a homeowner is given a redemption period, a timeframe during which they can reclaim the home after paying all necessary debt, even after the house is sold at auction. Collaborating with knowledgeable real estate agents in the Twin Cities is invaluable, as they can ease the complex web of real estate regulations and, as a result, assist in expediting the sale of the property with minimal costs.

Navigating Mortgage Arrears: Options for Homeowners in Twin Cities

Mortgage defaulting can be a headache for homeowners based in the Twin Cities, but knowing your choices can make handling this burden a little less complicated. It is strongly recommended that you take timely action, make decisions, and explore solutions to help prevent a situation where the house needs to be sold in foreclosure.

You may try resolving with the lender on a loan modification that is more geared to the borrower’s needs or a payback plan that will allow the borrower to be in a stable financial condition. A short sale application is another option, where a borrower can sell his/her house for a value lower than the outstanding loan, which is subject to lender approval.

A knowledgeable real estate agent who specializes in distressed properties can expedite the sale process and strategize with creditors in your favor. Also, thinking about a deed in lieu of foreclosure might let you transfer ownership out of your name with less damage to your credit score.

With professional help and understanding of these methods, Twin Cities homeowners can effectively manage their mortgages and carve a way out, even in challenging financial situations.

Avoiding Foreclosure: Alternative Solutions for Twin Cities Homeowners

Different options are available to assist Twin Cities homeowners facing difficulties with their mortgage payments and wishing to prevent foreclosure. One helpful option is a loan modification, which is when lenders change the terms of your mortgage to make payments easier, usually through extending the loan term or reducing the interest rate.

Pending lender approval, a short sale is another alternative that allows you to sell your home for less than you currently owe. Although your credit score will still take a hit, this method will enable you to avoid foreclosure.

Sometimes, homeowners consider a deed instead of foreclosure, where the homeowner willingly gives up the title to their property to the mortgage holder for a release from the mortgage debt. Also, a few might find succor from government-backed programs meant for financially distressed individuals, which provide help in refinancing or temporarily lowering payments.

Consulting with seasoned real estate experts who focus on distressed properties can help unravel these complicated matters and ensure you consider every alternative before defaulting on your mortgage.

At K&G Investments, we provide fast, fair cash offers to help Twin Cities homeowners avoid foreclosure. Whether you need a quick sale or a hassle-free solution, we handle the details so you can move forward with peace of mind.

Legal Considerations for Selling Property with Outstanding Debt in the Twin Cities

Understanding the legal aspects is essential when selling a house in the Twin Cities with an overdue mortgage. The first step is to examine your mortgage document. This will help you understand your rights and obligations concerning default and foreclosure.

Minnesota is a judicial foreclosure state, meaning lenders must sue the borrower to foreclose on the property. This provides homeowners with a little more flexibility and options. It makes sense to consult a Minnesota real estate attorney about workout loans, loan modifications, or short sales.

If you’re trying to avoid foreclosure, a short sale might assist you, as you can sell your house for less than what you owe; however, you will need your lender’s approval. Also, before any sale, any liens or judgments against your home must be resolved, so be sure to take care of these beforehand.

From my experience, I have seen that my clients can achieve better results when they employ early engagement strategies and focus on effective communication with lenders when negotiating payment settlements and restructuring financial obligations to allow for easier house sales.

Financial Assistance Programs Available to Distressed Homeowners in Minnesota

Minnesota has numerous financial assistance programs to help distressed homeowners in the Twin Cities. Homeowners can consider the Minnesota Housing Finance Agency’s Homeownership Assistance Fund, which provides financial grants and loans to cover overdue mortgage payments.

Another option is the Foreclosure Prevention Assistance Program, which offers counseling and the construction of case-based installment schemes to prevent foreclosure. Some nonprofit organizations in Minnesota actively help homeowners refinance or modify loans to reduce their monthly payments.

These support systems are crucial for homeowners seeking to navigate financial hardships and keep their homes despite being behind on mortgage obligations.

The Impact of Late Mortgage Payments on Selling Your Home in the Twin Cities

If you are behind on mortgage payments, you may struggle to sell your house in the Twin Cities. This could result in your credit score declining, which might refuel the already sluggish mortgage market, making it much more complicated for the would-be buyer to finance the mortgage.

This may result in sluggish house sales and a reduced buyer pool. Rising foreclosure rates may also make selling your house more difficult.

Frequent late mortgage payments can result in the need to sell the property through short sales or to investors, who provide immediate payment but cheaper rates. Additionally, in the Twin Cities, the market is competitive but requires a timely response, so these types of selling methods can lower the price of the home and the time it takes to sell.

Knowing why frequent mortgage payments and strategies for selling a home affect the mortgage balance is vital. Clear insight into the real estate market is useful.

Essential Steps to Prepare Your House for Sale When Behind on Payments

If you are late on mortgage payments and need to sell a house fast when you are behind on payments in the Twin Cities, taking critical steps to prepare your house for sale can dramatically help. As the first step, consider decluttering every room to help potential buyers imagine themselves living in the home.

Your property should look well-maintained to maintain a good appearance. Fix any minor repairs, like broken tiles or leaky faucets. Improving your property’s curb appeal is essential, too. You can do this by repainting the front door or refreshing the landscaping.

A skilled real estate agent can help you with your home’s value by listing it reasonably and competitively. House staging will bring out the house’s highlights, which can impress prospective buyers. This, along with the pricing strategy set by your agent, will pique buyer interest.

Moreover, ensure the required documents are filed, including proof of recent payments and any communication with your lender concerning missed payments or foreclosure notices. Concentrating on these steps will increase the chances of a sale, even with the financial hurdles.

Contact us today for a no-obligation cash offer on your Twin Cities home. We buy houses as-is, handle the details, and help you sell quickly—even if you’re behind on mortgage payments.

How to Sell a House Fast in Twin Cities: Proven Strategies

In the Twin Cities, homeowners behind on payments need not fret anymore because, with the right plan, losing a house to foreclosure can be avoided. The first thing to do is determine the fastest possible deal. Looking for firms that are correctly priced can be a handy tip.

If some notables, including but not limited to the condition, inherent and emotionally charged housing, and the amenities, can further assist with closing the deal, then marketing to experts is strongly advised.

Staging your home effectively helps potential buyers envision themselves living there, which can expedite the selling process. Utilizing professional photography for online listings is crucial, as it creates strong first impressions and broadens visibility among prospective buyers.

Working with a skilled real estate agent who can sell distressed properties in the Twin Cities will help you leverage their experience and negotiation skills to close deals quickly. Moreover, looking into them, like short sales, or reaching out to some investors who buy houses quickly, usually saves a lot of time.

Maximizing Home Value: Tips for Twin Cities Sellers Facing Financial Struggles

Though selling your house in the Twin Cities can be challenging when you are behind on mortgage payments, there are ways to improve its sale price and draw interest from buyers. Enhancing your property’s first impression goes a long way and can be done by refreshing the landscaping or repainting the exterior. These will significantly improve your curb appeal.

Within the house, concentrate on decluttering and staging every room to showcase its best features, exaggerating the size and appeal. Take care of small leaky faucets or cracked tiles, which may demotivate buyers and lower your house’s value.

Setting the price of your home is essential. Check the condition and location of your home relative to other homes in the Twin Cities to determine what price will be appealing and set it competitively. Working with an agent specializing in distressed sales can help you better understand the selling process and other sellers’ marketing strategies.

If need be, look for other selling avenues like short sales, which may help overcome the financial burden and achieve other favorable terms.

Setting the Right Price: Valuation Tips for Homes Behind on Payments

When you need to sell your house fast in St. Paul, Minneapolis, and surrounding Minnesota cities, especially if you’re behind on mortgage payments, setting the right price is crucial to attract buyers quickly and avoid foreclosure. Begin by obtaining a professional real estate appraisal to understand your property’s market value.

Think about hiring a local real estate agent who specializes in short sales and foreclosures so you can gain valuable knowledge about the market. They can perform a comparative market analysis, analyzing your area for recently sold comparable homes.

You should consider the repairs the home requires in relation to pricing. Furthermore, pay attention to the number of homes in the area, as a larger number would require a more aggressive price to sell.

Factoring in these elements will help ensure your home’s price aligns with what potential buyers are willing to pay while allowing you to cover outstanding mortgage balances efficiently.

Staging Tips to Enhance Appeal and Speed Up Sales Despite Payment Delays

Effective staging and selling the house in the Twin Cities while behind on payments can help attract potential buyers very quickly. Start selling the home by removing all the personal belongings in every room, which gives buyers a chance to imagine how their individual items will fit their lifestyle in the house.

Consider refreshing walls with a coat of neutral paint so rooms brighten up and give the illusion of being more spacious. Curb appeal is the first impression and requires the most focus, so maintain the lawn, trim the bushes, and add color with flowering plants.

Position furniture thoughtfully to showcase a house’s unique features and facilitate effortless movement from one room to the next. Make the space feel inviting and friendly by increasing the light to a warm and welcoming level using lamps and opening blinds and curtains during showings.

These suggestions will aid buyers in understanding the actual value of the house and hasten the sale regardless of payment lags. Following the suggestions will allow a smooth selling process of the house’s payment in a consecutive, simple, and convenient manner.

Exploring Cash Offers as a Quick Solution for Troubled Properties

Exploring cash offers can be a highly effective strategy for Twin Cities homeowners struggling with mortgage payments. When you’re behind on mortgage payments, traditional home-selling methods might not provide the speed you need to avoid foreclosure.

Cash house buyers in Minneapolis and other cities in Minnesota, who are often experienced real estate investors, can offer a quick, hassle-free solution for selling your property. These buyers are usually prepared to purchase homes as-is, so you won’t have to invest time or money into repairs or renovations.

This is especially beneficial when time is limited and money is tight. Cash sales are almost always quicker to close than conventional sales because the slower steps of mortgage approvals and appraisals are unnecessary.

Working with area cash buyers who know the Twin Cities ensures you receive competitive offers based on the market. This loop offers a much-needed respite from financial worries without navigating through a long period of uncertainty.

The Role of Short Sales in Managing Property Debt in the Twin Cities

Short sales can be an effective management strategy for homeowners in the Twin Cities who have property debt, especially when one is behind on mortgage payments. A short sale is selling the house with the mortgage lender’s agreement for an amount less than the outstanding mortgage balance.

It can be advantageous in the Twin Cities, as the housing demand and other pricing trends would affect the negotiations. Homeowners gain a lot more from short sales than foreclosures since their credit score won’t take a significant hit like it does with foreclosures.

Moreover, short sale specialists in the Twin Cities can facilitate better coordination with lenders, improving the overall process. These specialists not only know the region’s real estate intricacies but can also help build a persuasive argument for the lenders, which can result in the successful settlement of negotiated sales.

Understanding Equity and Its Importance When Selling an Encumbered Property

Understanding equity is crucial when selling a house in the Twin Cities, especially if you are behind on mortgage payments. Equity represents the difference between your property’s current market value and the outstanding balance on your mortgage.

When selling an encumbered property, knowing how much equity you have can determine your options for moving forward. If your home has positive equity, its market value exceeds the debt owed, allowing you to pay off your mortgage and cover selling costs with some profit remaining.

However, if you’re facing negative equity—where the mortgage balance surpasses the home’s worth—selling becomes more challenging and may involve negotiating with lenders to avoid short sales or foreclosures. Understanding these dynamics is essential to developing a strategic plan to sell your house effectively while minimizing financial loss and alleviating stress associated with being behind on payments.

By assessing your equity position accurately, you can decide whether selling at market value is feasible or explore alternative solutions like loan modifications or refinancing.

Tax Implications of Selling a Home Under Financial Duress

Selling a home in the Twin Cities when you’re behind on mortgage payments can have significant tax implications, especially when facing financial duress. Understanding how potential capital gains taxes might affect you is crucial, even if your primary goal is to avoid foreclosure.

When selling a property under financial strain, it’s essential to determine whether the sale results in forgiven debt, as the IRS could consider this taxable income. Homeowners should also explore any exclusions available for primary residences, which may help reduce or eliminate capital gains tax if certain conditions are met.

Additionally, understanding Minnesota’s state-specific tax regulations can provide further insight into the financial outcome of such a sale. Consulting with a tax professional who understands federal and state laws regarding distressed property sales can ensure that you navigate this complex situation effectively and avoid unexpected liabilities.

Closing the Deal: Finalizing Your Sale While Managing Debt Challenges

Closing the deal on your house in the Twin Cities while managing debt challenges requires strategic planning and effective negotiation. When you’re behind on mortgage payments, it’s crucial to communicate openly with potential buyers and lenders to facilitate a smooth sale.

One option is to consider a short sale, which involves selling the property for less than what you owe on the mortgage, with lender approval. This can help you avoid foreclosure and minimize credit damage.

Working with an experienced real estate agent who understands the local market dynamics in the Twin Cities can be invaluable, as they can guide you through pricing strategies and buyer negotiations. Additionally, being transparent about your financial situation with buyers can foster trust and expedite the closing process.

It’s essential to stay organized by keeping all necessary documents readily accessible, including any agreements with your lender regarding debt repayment or short sale terms. By addressing these factors proactively, you will better position yourself to successfully finalize the sale of your home while effectively managing existing debt obligations.

Common Mistakes to Avoid When Selling a House with Missed Payments

When selling a house in the Twin Cities while behind on mortgage payments, homeowners often make common mistakes that can hinder their success. One significant error is neglecting to communicate with their lender about missed payments, which can lead to unnecessary complications and stress.

Setting an unrealistic asking price is another frequent misstep; an overpriced home may languish on the market, causing further financial strain. Homeowners overlook essential repairs or upgrades, which can deter potential buyers and decrease the property’s value.

Skipping professional advice by not consulting a real estate agent experienced in distressed sales can lead to poor marketing strategies and missed opportunities for quick sales. Furthermore, failing to understand local market conditions in the Twin Cities can result in pricing decisions that do not reflect current demand or housing trends.

By avoiding these pitfalls, sellers can better navigate the challenging process of selling a house with missed mortgage payments.

How to Avoid Closing If I’m Behind on a Mortgage?

If you’re behind on your mortgage payments in the Twin Cities and want to avoid foreclosure, there are several strategies you can consider. First, contact your lender as soon as possible to discuss your situation; they may offer loan modification options or a repayment plan tailored to your financial circumstances.

Additionally, consider selling your house quickly by working with a real estate agent experienced in short sales or by listing it at a competitive price to attract buyers swiftly. Exploring government programs designed for homeowners in distress can also provide relief options.

Furthermore, consult a housing counselor who can guide you through the process and help negotiate with creditors. By taking proactive steps, you can potentially sell your home before foreclosure proceedings begin, preserving your credit score and financial future while navigating the complexities of the Twin Cities’ real estate market.

How Long Does It Take to Foreclose on a House in MN?

In the Twin Cities, understanding the foreclosure timeline is crucial for homeowners behind on mortgage payments and looking to sell their house. In Minnesota, the foreclosure process typically begins after a homeowner has missed several mortgage payments, usually around three to four months.

Once initiated, the foreclosure process can take anywhere from six months to over a year, depending on factors such as lender efficiency and court schedules. Homeowners should know that Minnesota follows judicial and non-judicial foreclosure processes with different timelines and implications.

Judicial foreclosures involve court proceedings and tend to take longer, often extending the timeline significantly. Conversely, non-judicial foreclosures proceed more quickly since they bypass court involvement.

Those behind on mortgage payments in the Twin Cities must consider selling their house before reaching this stage to avoid potential credit damage and financial stress associated with foreclosure. Consulting with real estate professionals or attorneys specializing in distressed properties can provide valuable guidance on navigating this complex situation efficiently.

Need to sell your house fast? K&G Investments buys homes as-is for cash, handles everything, and makes the process stress-free. Call (612) 400-8070 today for a no-obligation offer!

| MORTGAGE PROVIDER | HOME LOAN | MORTGAGE LOAN | FORECLOSING | FORECLOSURE SALE | MORTGAGE FORECLOSURE |

| BORROWERS | SHERIFF’S SALE | SHERIFF’S SALE | LAWYER | FEES | DEFAULTED |

| SHERIFF | SCAMMER | SCAM | SCAM ARTIST | REALTOR | |

| BANKRUPTCY | REFINANCE | FORBEARANCE | THE U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT | UNITED STATES DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT (HUD) | HUD |

| INTEREST RATES | FSBO | CREDIT REPORT | CREDIT HISTORY | BANK | AFFIDAVIT |

| U.S. | UNITED STATES | MORTGAGE SERVICER | YOU’RE BEHIND ON PAYMENTS | I’M BEHIND ON PAYMENTS | TO A CASH BUYER |

| UNDERWATER ON YOUR MORTGAGE |

Helpful St. Paul Blog Articles

- How To Successfully Sell Half Of Your St. Paul Home

- Maximize Your Home Sale In St. Paul

- Is A Deed Required To Sell Your House In St. Paul, MN

- Intriguing Real Estate Facts About The Twin Cities Housing Market

- Understanding FSBO Costs For Home Sellers In The Twin Cities

- How To Minimize Closing Costs In Twin Cities

- Sell Your House In The Twin Cities When Behind On Mortgage Payments

- Capital Gains Tax After Selling a House in St. Paul, MN

- Guide To Navigating Condemned House Regulations In St. Paul, MN

- Can the Executor Change the Will in St. Paul, MN

- How Long to Live in a House Before Selling in St. Paul

- Can I Sell My Parents’ House in Saint Paul, MN with Power of Attorney

- Do I Need A Realtor to Sell My House in Saint Paul, MN