Understanding the Role of an Executor in Estate Planning

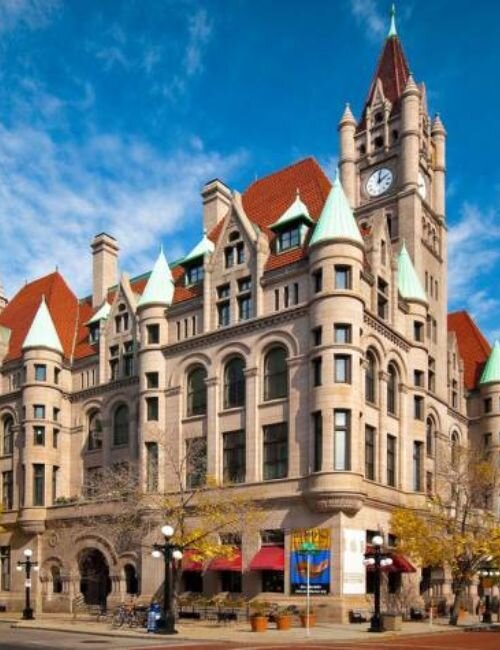

The function of an executor in estate planning is essential, particularly in the context of the management of real estate assets in St. Paul, MN.

Executors are accountable for efficiently and accurately fulfilling the intentions specified in a will. They are authorized to oversee and distribute the estate’s assets, which may include the sale or transfer of property.

In St. Paul, executors are required to comply with the specific instructions of the will regarding real estate while also navigating local probate laws.

Executors typically have some discretion in addressing unforeseen circumstances related to real estate transactions, despite the fact that wills are generally unalterable after the testator’s death. They are required to maximize the value of property sales or maintain properties until they can be distributed in accordance with the terms of the will, all while upholding fiduciary duties and acting in the best interest of beneficiaries.

An executor’s ability to successfully manage real estate within an estate plan, while ensuring both legal compliance and the protection of beneficiary interests in St. Paul, is strengthened by a clear understanding of these responsibilities. Partnering with cash home buyers in St. Paul and surrounding Minnesota cities can also provide a practical solution for handling estate property efficiently.

Key Differences Between a Will and a Living Trust

Both a will and a living trust are important tools for planning your estate, but they have different purposes and features, especially when it comes to managing real estate in St. Paul, MN. A will is a legal document that tells people how to divide up a person’s property, including their real estate, after they die.

A living trust, on the other hand, is set up while the person is still alive and lets them manage and distribute their assets without going through probate. A will only goes into effect after death, but a living trust goes into effect right away. This means that if the grantor becomes unable to manage their property, a living trust can do so without any problems.

In Minnesota, wills have to go through the probate process, which can take a long time and be public. A living trust, on the other hand, usually doesn’t have to go through probate, which makes the transfer of property more private. In St. Paul, this difference is very important because avoiding probate can help resolve real estate issues more quickly.

Until probate is finished, executors named in wills have limited powers. On the other hand, trustees of a living trust can immediately handle real estate matters like sales or transfers according to the terms of the trust document. People can make better decisions about how to manage their real estate in St. Paul through wills or trusts if they understand these differences.

Duties of Executors: What You Need to Know Before Accepting the Role

When considering the role of executor in St. Paul, MN, it’s critical to understand the full scope of responsibilities, particularly those involving real estate and potential will changes.

Executors are legally responsible for managing and distributing the deceased’s estate in accordance with the terms of the will, which includes all assets such as real property. In St. Paul, executors must navigate local real estate laws while ensuring that all debts and taxes are paid before any distribution takes place. Executors must act in the best interest of beneficiaries and cannot change a will’s provisions without court approval or explicit authorization from the document itself.

This position necessitates meticulous attention to detail and knowledge of probate procedures, as failure to comply with legal obligations may result in personal liability. Executors must also communicate clearly with heirs and beneficiaries in St. Paul in order to manage expectations and provide transparency throughout the estate settlement process.

Legal Responsibilities of Executors in Minnesota

Executors in Minnesota have significant legal responsibilities when managing an estate, particularly with regard to real estate in St. Paul.

An executor is responsible for making sure the deceased’s will is honored according to their wishes and state laws. This involves locating and securing all assets, including real estate, and arranging appraisals to establish their value. If selling a property becomes necessary, here’s how K&G Investments can help simplify the process.

Before distributing assets to beneficiaries, executors must resolve any outstanding debts and taxes. Executors must act in the best interests of the estate and its beneficiaries, while strictly adhering to Minnesota probate laws.

Although executors have some discretion, they cannot change the terms of a will unless the court explicitly authorizes it or if all beneficiaries agree to the changes. Failure to perform these duties may result in legal liabilities, so executors in St. Paul must fully understand their role and seek legal counsel as needed.

The Impact of State Laws on Executor Duties and Powers

State laws have a big impact on what an executor can and can’t do with real estate in a will in St. Paul, Minnesota.

Minnesota laws spell out what executors can do with an estate, including how they can manage it and make changes to it, such as how to handle real property. Executors have a duty to act in the best interests of the beneficiaries, but they usually can’t change wills unless certain conditions set by probate law are met.

State laws require executors to follow the will’s instructions exactly, but they can ask probate courts to change the will if there are good reasons to do so. This legal framework makes sure that executors do their jobs honestly and protects the wishes of the deceased as they are written down in their will.

Executors must be very careful when following these legal rules. They often need to talk to lawyers to make sure they are following Minnesota’s complicated probate rules about real estate transactions in an estate plan.

Can an Executor Change a Will? Exploring Legal Boundaries

When dealing with real estate issues in a will in St. Paul, Minnesota, it is critical to understand the legal limits of an executor’s authority.

A will’s terms are legally binding, and the executor designated to manage the deceased’s estate must strictly adhere to them. It is the executor’s responsibility, not their own, to carry out the testator’s desires in accordance with the terms of the will.

However, uncertainties or unanticipated events can have an impact on real estate holdings. If the instructions were ambiguous, or if the executor needed to sell assets to pay off debts or evenly distribute them among beneficiaries, they could seek advice from the probate court.

However, if the changes make a change to the real estate that is not consistent with the will’s original purpose, court approval is required, and the changes must comply with Minnesota state laws. Executors who are aware of these limitations can manage estates more effectively and in accordance with their fiduciary responsibilities.

Understanding Beneficiary Rights During Probate

In St. Paul, MN, beneficiary rights are very important to know how executor powers can affect the distribution of real estate as stated in wills.

Beneficiaries have the right to know what is going on with the probate process and to get a copy of the will. The executor must be open and honest with them about any choices that could affect their inheritance, even if those choices involve real estate.

Executors have a lot of power when it comes to managing and distributing estate assets, but they must follow the instructions in the will and Minnesota probate law. Any changes to or sale of real estate must be in the best interests of all beneficiaries and follow the law.

Beneficiaries also have the right to challenge any actions they think violate their rights or go against what the testator wanted. Beneficiaries can make sure that executors do their fiduciary duties correctly during the probate process if they know these rights.

Common Challenges Faced by Executors and How to Overcome Them

Executors in St. Paul, Minnesota, frequently face a number of challenges when managing a deceased person’s estate, particularly real estate issues outlined in wills.

One common issue is understanding the legal boundaries of their executor’s powers when it comes to changing or interpreting the terms of a will governing property distribution. Executors must navigate state laws and probate court regulations to ensure compliance and address any ambiguities in the will’s language pertaining to real estate.

Family conflicts can arise when beneficiaries disagree on property decisions, necessitating diplomatic mediation by executors while remaining true to the wishes of the decedent. Executors may also have difficulty accurately valuing real estate or managing estate-owned properties until they can be sold or transferred.

To address these issues, executors should consult with experienced estate attorneys who are familiar with Minnesota probate law, as well as consider hiring professional appraisers to provide accurate property valuations. Executors can effectively manage these challenges and fulfill their fiduciary responsibilities by maintaining constant communication with all parties involved and keeping meticulous records throughout the process.

Tax Implications for Estates and Executors Explained

It is essential to understand the tax implications for executors and beneficiaries of estates in St. Paul, MN, particularly when real estate is part of the estate. In these situations, K&G Investments can help provide guidance and solutions.

An executor bears significant responsibility for managing the estate’s assets, including any real property, and must carefully navigate federal and state tax obligations. In Minnesota, estate taxes can be imposed if the total value of the estate exceeds a certain threshold, necessitating precise calculations to ensure compliance.

Executors must also consider the capital gains tax implications if they decide to sell real estate during probate. The stepped-up basis rule adjusts the property’s value at the time of inheritance, not the original purchase price, which can impact these calculations.

Furthermore, if changes to a will are made in order to distribute or sell real estate differently, this may affect how taxes are applied to beneficiaries’ inheritances. Understanding these complexities allows executors to manage estates more effectively while reducing potential tax liabilities for all parties involved.

What Control Does an Executor Have Over a Will?

An executor is very important for managing and carrying out the terms of a will, especially when it comes to buying and selling property in St. Paul, MN. Anyone who is involved in estate planning or probate needs to know what the executor can do.

The executor is in charge of making sure that the assets are distributed according to the will. This means that all debts and taxes must be paid before the beneficiaries can get their inheritance. However, executors can’t change the terms of a will on their own; they have to follow the will’s rules exactly unless all of the beneficiaries agree to any changes. In St. Paul, MN, as in other places, executors have to deal with complicated laws about probate and estate administration, especially when it comes to real estate. It is the job of the executors to protect the estate’s assets. This may mean selling property to pay off debts or carry out specific bequests made in the will. They have a lot of say over how these tasks are done, but most of the time, their actions need to be approved by a court during probate proceedings.

So, executors in St. Paul, MN, who are in charge of estates with real estate, need to know about these limits and duties.

How to Amend a Will in Minnesota?

In Minnesota, you need to be very careful about following the law when you change a will, especially if it involves property in St. Paul. This is to make sure that the changes are legally binding.

If you want to change a will in Minnesota, you can do so by making a codicil. This includes changing terms related to real estate assets. A codicil is an official document that changes the original will. It must be signed and witnessed in the same way as the original will.

This means that the testator must sign it, and at least two people who are not beneficiaries of the will must see it. People in St. Paul and the rest of Minnesota need to know that trying to change a will without following these specific legal steps could cause problems during probate. It is also a good idea to talk to an experienced estate planning lawyer in Minnesota when you are dealing with big assets like real estate.

They can help you make sure that all changes are in line with state law and accurately reflect your current wishes. It is also important to know what powers executors have because they can’t change wills very much. Their main job is to carry out the wishes of the deceased as written in the will, unless a court order or valid codicil says otherwise.

How Long Does an Executor Have to Settle an Estate in MN?

In Minnesota, several factors and legal requirements influence how long it takes an executor to settle an estate, including real estate in St. Paul.

The probate process typically lasts six months to a year, but this can vary depending on the complexity of the estate and any potential disputes. Executors are in charge of managing the deceased’s assets, repaying debts, and distributing property in accordance with the will.

When necessary actions are delayed or contested, the estate settlement process may take longer. Executors must follow Minnesota state laws and court orders while performing their duties efficiently.

In St. Paul and throughout Minnesota, executors must also consider tax obligations and ensure that all beneficiaries receive the inheritance specified in the will.

Understanding these timelines and responsibilities assists in ensuring that real estate issues within an estate are handled correctly and efficiently in accordance with local regulations.

What Happens If an Executor Changes a Will?

When discussing executor powers and the limits on changing wills, it’s essential to understand that an executor cannot alter a will, particularly in matters involving real estate in St. Paul, MN. In such situations, working with investor home buyers in Minneapolis and other cities in Minnesota can offer a straightforward way to handle estate property.

According to Minnesota law, an executor’s job is to carry out the wishes of the will exactly as they are written. But there may be times when beneficiaries wonder if changes can be made, especially when it comes to real estate.

If an executor tries to change a will or change how property is divided without a good reason, those actions could be challenged in probate court. This could cause problems between the beneficiaries and lead to long court battles.

In St. Paul, as in other places, a testator must have made any valid changes to a will before they died by using a valid codicil or a new will.

Executors should focus on following the original document when managing the estate. If they run into any problems or questions about how to handle real estate under Minnesota law, they should get legal help.

Helpful St. Paul Blog Articles

- How To Successfully Sell Half Of Your St. Paul Home

- Maximize Your Home Sale In St. Paul

- Is A Deed Required To Sell Your House In St. Paul, MN

- Intriguing Real Estate Facts About The Twin Cities Housing Market

- Understanding FSBO Costs For Home Sellers In The Twin Cities

- How To Minimize Closing Costs In Twin Cities

- Sell Your House In The Twin Cities When Behind On Mortgage Payments

- Capital Gains Tax After Selling a House in St. Paul, MN

- Guide To Navigating Condemned House Regulations In St. Paul, MN

- Can the Executor Change the Will in St. Paul, MN

- How Long to Live in a House Before Selling in St. Paul

| INHERITANCE RIGHTS | DISINHERITED | DISINHERITS | CHILDREN | CHILD | SPOUSE |

| SURCHARGE | FEES | UNDUE INFLUENCE | INTESTATE | WITHOUT A WILL | INTESTATE SUCCESSION |

| TYING THE KNOT | MARRIAGE | SIBLINGS | THE TWIN CITIES | TWIN CITIES, MN | TWIN CITIES, MINNESOTA |

| FIDUCIARIES | WITNESSES | INFORMATION | JOINT TENANTS | JOINT TENANCY | MONEY |

| JUDGE | GRANDCHILDREN | GRANDCHILD | EAGAN | EAGAN, MINNESOTA | DIVORCE |

| BLOOMINGTON, MN | BANK | ADULT | IN YOUR WILL | A WILL TO | WITHOUT A WILL |

| CHANGES TO YOUR WILL | DIE WITHOUT A WILL |