Dealing with unpaid property taxes, including actions from the tax collector, can feel overwhelming for many homeowners in Minneapolis. When balances start adding up, it becomes more than a financial issue—it turns into a source of stress, pressure, and uncertainty about what comes next. Life circumstances such as job loss, medical emergencies, or bankruptcy can make it difficult for homeowners to keep up with property tax payments. Property taxes in Minnesota are strictly enforced, and when payments fall behind, the consequences can escalate quickly. If you’re a Minneapolis homeowner struggling with unpaid property taxes, understanding your options can help you move forward with confidence. Whether you want to keep your home or sell it quickly before penalties grow, acting early often creates the best outcome.

Understanding How Unpaid Property Taxes Affect Minneapolis Homeowners

Unpaid property taxes don’t exist in a vacuum. In Minneapolis, once you miss a payment, the county adds penalties and interest, and the balance continues to grow. Over time, this debt can turn a manageable situation into a serious financial challenge. Many homeowners don’t realize how quickly unpaid property taxes can impact their ownership. Within a certain timeframe, delinquent taxes can even put the property at risk of tax forfeiture. After three years of delinquency, the property may become eligible for forfeiture or tax sale. When this happens, the county gains legal rights to the property, and a lien is placed on the property due to unpaid taxes. The homeowner risks losing ownership entirely if action isn’t taken soon enough.

This process often feels stressful because homeowners aren’t always prepared for how fast things can escalate. Life circumstances such as job loss, medical emergencies, inherited homes, or unexpected repairs can cause even the most responsible homeowners to fall behind. Once the letters and penalties start arriving, homeowners will receive a notice from the county regarding their delinquent status, and it becomes difficult to catch up. The key is recognizing the issue early and exploring solutions, such as those involving a letter of guarantee, that match your timeline and needs.

Why Property Taxes Matter So Much in Minneapolis

The structure of property taxes in Minneapolis plays an important role in how quickly unpaid amounts become a problem. Minnesota counties rely heavily on property tax revenue to fund essential services. Because these funds support schools, roads, emergency services, and public programs, the state and counties enforce collection aggressively, often leading to personal financial burdens for homeowners . When taxes remain unpaid, penalties accumulate and extra fees are applied to the homeowner’s balance.

The longer taxes go unpaid, the harder it becomes to reverse the situation. Once a property enters the delinquency stage, you receive notices and eventually a judgment. After that, the redemption period begins, and if the taxes still aren’t paid, the home may eventually be forfeited to the state. Homeowners facing this process often feel the pressure increasing month after month, especially when their financial situation isn’t improving. It is the homeowner’s responsibility to address unpaid taxes prior to the end of the redemption period to avoid forfeiture. This is why many Minneapolis homeowners look for relief long before the situation reaches the forfeiture stage.

The Emotional and Financial Toll of Unpaid Property Taxes

Many homeowners underestimate how much stress unpaid property taxes can cause until they’re in the middle of it. Constant notices, growing balances, and fear of losing the property, possibly leading to a warrant for collection, make the situation feel heavier every month. Losing the property means losing title to the real property, which can have long-term financial consequences for the owner. For Minneapolis homeowners who have lived in their property for years or inherited a family home, the stress is even higher.

Some homeowners try to fix the issue with payment plans, but these aren’t always realistic if the total amount owed continues to grow due to penalties. Others attempt to refinance, but many lenders won’t approve a loan when unpaid property taxes are involved. Repairing the home before selling also becomes difficult because past-due taxes limit access to funds and make traditional sales more complicated. Understanding these emotional and financial pressures helps explain why more homeowners are turning to faster, more reliable solutions in their business transac .

Why Selling the Property May Be the Easiest Option

For many Minneapolis homeowners, selling becomes the fastest and most effective way to get relief from unpaid property taxes. When the debt grows beyond what feels manageable or when catching up simply isn’t realistic, selling the property quickly can help stop the situation from getting worse. If the property, including land, is not sold in time, it may be subject to a tax sale, where the land is auctioned by the county, as mentioned on their website, to recover unpaid taxes. A traditional sale can work, but it usually requires repairs, cleaning, showings, waiting on buyers, and dealing with agents—steps that are difficult when the clock is ticking and the unpaid property taxes are climbing.

Many homeowners with tax debt don’t have the luxury of waiting months for the perfect buyer or negotiating repairs. When property taxes are owed, time is one of the most important factors, and acting quickly helps prevent the county from moving forward with further consequences. This is why a fast, streamlined sale is often the best path for homeowners who want immediate relief, especially when dealing with a tax certificate .

How a Cash Home Buyer Helps Homeowners With Unpaid Property Taxes

Selling to a reputable cash home buyer has become one of the most efficient ways for Minneapolis homeowners to resolve unpaid property taxes without extra stress. A cash buyer can purchase the home as-is, without requiring repairs or inspections. This matters because many properties with tax debt also have deferred maintenance or issues that would complicate the transfer of a deed, making traditional selling harder.

A cash buyer can also close quickly, often in a matter of days, which is important when deadlines are approaching. Instead of waiting for mortgage approvals or dealing with delays, the sale is straightforward and predictable. The cash buyer pays off the unpaid property taxes at closing, ensuring the homeowner isn’t stuck clearing the debt on their own. Cash buyers often provide a guarantee of funds, such as a bank guarantee or letter of guarantee, along with a list of their credentials to assure the seller that payment will be made and the transaction will close smoothly. This approach gives homeowners a clean break and allows them to move forward without the weight of growing tax penalties.

Minneapolis homeowners also appreciate that selling to a cash buyer avoids the need for showings, open houses, or months of uncertainty. The process is simple: the property is assessed, a cash offer is made, and once accepted, the closing timeline is chosen by the homeowner. Sometimes, agents may represent buyers in these transactions, submitting offers and handling negotiations on their behalf. It’s a solution designed for people who need relief quickly and want a direct path out of a difficult situation; homeowners should also contact their county office for advice .

The Benefits of Selling Before Taxes Become a Bigger Problem

Selling while unpaid property taxes are still manageable is often the best decision. Once the home enters the more severe stages of delinquency, options become more limited. Acting early gives homeowners more control, more time, and a greater chance of achieving a smooth and successful outcome. Many people assume their situation is too complicated, but cash home buyers regularly work with taxpayers who have significant unpaid tax balances, liens, or years of accumulated penalties. If unpaid taxes are not resolved, the county may issue a tax certificate, which can be sold to investors. These certificates represent a lien on the property and accrue interest until the owner redeems them.

The earlier a homeowner chooses to sell, the easier the process generally becomes. Instead of waiting for the county to initiate the forfeiture process or letting interest continue to grow, selling for cash can create immediate financial relief. Before selling, homeowners should review the property file for any outstanding tax certificates or liens. This path helps homeowners protect their equity and avoid losing the property altogether, which could involve a court action if they fail to act .

What Happens at a Public Auction for Tax-Delinquent Properties

When property taxes go unpaid for an extended period, the county treasurer—acting as the tax collector—may initiate a public auction to recover delinquent taxes and related costs. This public auction is a legal process where delinquent property is sold to the highest bidder, and the proceeds are used to pay off the outstanding property taxes, penalties, and any additional fees associated with the subject property, often initiated by the county office .

For prospective bidders, participating in a public auction begins with registration, which often requires submitting a deposit in the form of a cashier’s check or money order. Each property up for auction will have a minimum bid, typically set to cover the delinquent taxes, penalties, and any costs incurred by the county. The auction itself is open and competitive, with potential bidders raising their offers until the highest bidder is determined, ensuring all bids are made by authorized participants .

Once the auction concludes, the highest bidder must make full payment—usually immediately or within a short timeframe—using a cashier’s check or money order. This payment must cover the full amount of the winning bid, along with any additional fees required by the county. After payment is received, the buyer is issued a tax deed, which transfers ownership of the property. It’s important to note that the new owner may be responsible for any remaining liens, current taxes, or other expenses tied to the property as of the auction date , so thorough research before bidding is essential.

The property tax division or county treasurer’s office typically provides additional information about each subject property, including details on current taxes owed, outstanding liens, and the minimum bid required. Notices of the public auction for each parcel are sent to the property owner and published in local newspapers, as required by law. In states like California, the California Revenue and Taxation Code outlines the procedures for these auctions, ensuring transparency and fairness for all parties involved.

For taxpayers facing delinquency, it’s crucial to understand that once a property is sold at public auction, ownership is transferred to the highest bidder, and the previous owner may lose all rights to the property. However, there are often opportunities to avoid this outcome by paying the delinquent taxes in full or by arranging an installment agreement with the county treasurer upon request before the auction date.

If you’re considering bidding at a public auction or are a property owner concerned about delinquent taxes, you can contact the county treasurer or property tax division for additional information. Most counties maintain a website with details about upcoming auctions, including a list of properties, minimum bids, and instructions for submitting bids and making payments. You can also request information about your property tax account, outstanding balances, and available options for resolving a delinquency.

Understanding the public auction process—and acting early—can help both property owners and potential buyers make informed decisions, avoid unnecessary costs, and ensure a smoother experience when dealing with tax-delinquent properties.

Moving Forward After Dealing With Unpaid Property Taxes

Once the property is sold, homeowners often experience a sense of relief they haven’t felt in months. Without the burden of unpaid property taxes hanging over them, they’re able to rebuild, reset, and move forward. Many homeowners use the proceeds from the sale to secure more affordable housing or to catch up on other financial responsibilities. The important thing is that they’re no longer carrying the stress and pressure that comes from a growing tax burden.

Moving forward becomes easier when the problem is resolved quickly. Minneapolis homeowners often say they wish they had taken action earlier, especially after realizing how simple the process can be with the right help. Whether the home was inherited, lived in for years, or purchased recently, resolving unpaid property taxes brings clarity and stability back into the homeowner’s life.

Conclusion

Unpaid property taxes can feel overwhelming, but you’re not out of options. Minneapolis homeowners have more choices than they realize, and the situation doesn’t need to reach the point of forfeiture. The key is understanding the process, recognizing the urgency, and taking steps that protect your financial future. Selling the home quickly to a cash buyer is often the most effective way to eliminate the debt, stop penalties from growing, and gain immediate peace of mind.

If you’re struggling with unpaid property taxes and want a fast, reliable solution, a cash home buyer can help you move forward without stress or delays. You’re not alone, and relief is closer than you think.

For answers to your property tax questions, be sure to consult official resources or contact your county office for guidance.

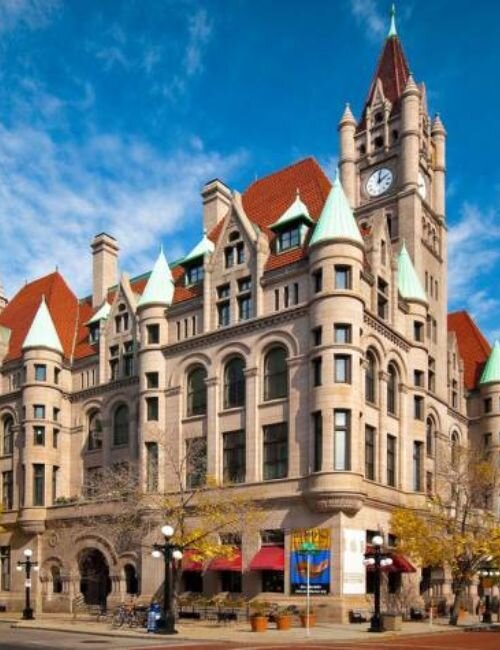

Helpful St. Paul Blog Articles

- Can Heir Property Be Sold in St. Paul, MN

- How Long After an Appraisal Can You Close in St. Paul, MN

- How to Sell a House in Bankruptcy in St. Paul, MN

- Selling My Parents’ House in St Paul, MN

- Sale Of A Rental Property in St. Paul, MN

- Selling A House With Termite Damage in St. Paul, MN

- Selling A House To A Family Member in St. Paul, MN

- Sell a House in St. Paul, MN, When Relocating

- Selling Home with Reverse Mortgage in Saint Paul, MN

- Selling Your House to a Relocation Company in Saint Paul, MN

- Can an Estate Administrator Sell Property in Saint Paul, MN

- How to Sell a House When You Are Behind on Payments in St. Paul, MN