Inheriting a property can seem like a blessing at first. The idea of owning a home or receiving real estate as part of an estate can feel like a financial windfall. However, for many Minneapolis homeowners, the reality is far more complicated. The stress of inheriting a property can be silent, creeping into your daily life, finances, and emotional well-being. This is especially true when the property was unexpected, when you live far away, or when maintaining the property feels overwhelming due to the emotional burden it brings.

Understanding the Stress of Inheriting a Property

Inheriting a home is not always a simple process. Unlike purchasing a property with clear intentions, inherited homes come with responsibilities you didn’t choose. From ongoing maintenance to legal paperwork, the stress of inheriting a property can accumulate quickly. Many homeowners find themselves juggling tasks such as securing the property, managing taxes, or coordinating repairs—sometimes while dealing with the grief of losing a loved one.

Financial pressure is one of the first challenges most inheritors face. Even if the house has significant value, it may come with unexpected costs. Property taxes, utility bills, and upkeep expenses can pile up, creating a financial burden. In Minneapolis, property taxes can vary widely depending on the neighborhood, and failing to pay them can result in fines or liens. These hidden costs often turn a seemingly valuable inheritance into a source of worry rather than relief.

Emotional Challenges of Unexpected Homeownership

Beyond finances, the emotional impact of inheriting a property is often underestimated. For many, the property carries memories of the deceased loved one, which can make decisions about selling or renovating feel emotionally complicated. Letting go of a family home can feel like betraying the memory of a relative, and many people may feel guilty about selling or even keeping the property, especially when family expectations or disagreements are involved. On the other hand, holding on may feel like a constant reminder of loss.

Additionally, inheriting a property you didn’t plan for can create tension among family members. Siblings or relatives may have different opinions about what to do with the home. Disagreements over whether to sell, rent, or keep the property can strain relationships, adding another layer to the stress of inheriting a property.

Challenges of Managing a Property From Afar

Many inheritors live far from the property they’ve received. Managing a home from another city—or even another state—can be logistically challenging. Regular property maintenance, finding trustworthy contractors, and ensuring the property remains secure can feel overwhelming. Minneapolis weather adds another complication, with harsh winters that can cause damage to roofs, plumbing, and landscaping. Without proper attention, even small issues can escalate, leaving you with costly repairs and a growing sense of stress.

Remote management also makes it difficult to prepare the home for sale if you choose that route. Staging, cleaning, or conducting repairs from afar can be frustrating and expensive, especially if you have other responsibilities or jobs that demand your attention. This distance amplifies the silent stress of inheriting a property, as each unresolved task lingers in the background, creating ongoing anxiety.

Maintenance and Upkeep Responsibilities

Inheriting a property means stepping into the role of property owner, with all the responsibilities and property expenses that come with it. One of the first things many families notice is the ongoing cost of property taxes, which in Minnesota can add up to tens of thousands over the years, depending on the location and market value of the home. As the new owner, you’re now responsible for making sure these taxes are paid on time to avoid penalties or liens that could complicate your financial situation.

Beyond taxes, inherited homes often require regular maintenance and unexpected repairs. From routine tasks like snow removal and lawn care to more urgent issues such as fixing frozen pipes or addressing decades worth of wear and tear, the maintenance costs can quickly become overwhelming—especially if the property has been vacant or neglected. If you’re not living nearby, hiring a property management company may be necessary to handle these maintenance issues and keep the property in good condition, but this adds another layer of expense and coordination.

Repair costs can also be significant, particularly if the inherited house is older or hasn’t been updated in years. Before making any decisions, it’s wise to assess all the details of the property’s condition and create a plan for addressing urgent repairs. This is especially important if you’re considering selling the property, as potential buyers will be looking for a home that’s well-maintained and move-in ready.

If you decide to sell the property, be aware of the potential capital gains tax implications. Selling inherited property for more than its market value at the time of inheritance can result in capital gains, which may affect your tax bill. Consulting a tax advisor can help you understand your specific tax implications and plan ahead to minimize any surprises.

For many families, the emotional weight of maintaining a family home can be just as challenging as the financial burden. Emotional attachments to the property, combined with the pressure of making the right decision for all heirs, can make the process feel even more time consuming and overwhelming. When multiple heirs are involved, open communication and a clear plan are essential to ensure everyone’s interests are respected and the property is managed in line with the deceased person’s wishes.

Ultimately, whether you choose to keep, rent, or sell the property, prioritizing maintenance and understanding all the associated costs will help protect your investment and preserve the property’s value. Taking the time to plan, seek professional advice, and communicate with other heirs can turn an overwhelming experience into a manageable one, allowing you to honor your loved one’s legacy while making sound financial decisions for the future.

Legal and Property Taxes Implications

Inheriting a property is not just about ownership—it comes with legal and tax responsibilities that can be confusing for first-time inheritors. Minnesota laws, legal issues, and the legal process—including probate rules and federal estate taxes—all play a role in determining what you must do after receiving a home. Failing to understand these requirements or lacking an estate plan can result in penalties or complications that add to your stress. It is highly recommended to consult an attorney to help navigate these legal matters and ensure compliance.

For example, transferring the title, filing probate process paperwork, and handling liens or back taxes related to the deceased person’s estate can be time-consuming and complex. If the deceased person’s will is being validated, the probate court may require additional legal steps, and court involvement can occur if there are disputes among heirs. Homeowners who attempt to manage these matters without professional help may find themselves overwhelmed, frustrated, and worried about making mistakes that could have long-term financial consequences, including missing out on the step up in basis for tax purposes.

Selling as a Solution to Reduce Stress

For many Minneapolis homeowners, selling the inherited property can be the most practical way to relieve the stress of inheriting a property. Many sellers face similar emotional and logistical challenges during the selling process, especially when dealing with inherited homes. A cash home buyer can provide a fair offer, understanding local laws and market conditions, and handle the complicated aspects of the sale process, from repairs to managing the closing. This approach allows you to focus on your own life, rather than the responsibilities of maintaining a property you never asked for.

Selling for cash also provides speed and certainty, allowing you to sell your property quickly. If you need to sell your house fast, cash buyers can often close in as little as a few weeks, regardless of current market conditions. Unlike traditional home sales, which can take months and require open houses, inspections, and negotiations, a cash sale streamlines the process. This quick turnaround can ease financial pressure, help cover taxes or outstanding bills, and give you peace of mind.

Moreover, selling eliminates the burden of ongoing maintenance and avoids potential disputes with family members. If the property has been vacant for a while, selling can prevent damage from neglect and reduce stress associated with security concerns. For many, the relief of passing on the responsibility is well worth the decision.

How to Approach the Decision Mindfully

Deciding what to do with an inherited property is never simple. The key is to approach the decision mindfully, weighing both emotional and financial considerations. Start by evaluating the property’s current condition, market value, and potential costs. Consider how much time, energy, and money you’re willing to invest in upkeep or renovations.

It’s also important to communicate with family members and, if necessary, legal professionals to understand any obligations or restrictions attached to the inheritance. By having a clear picture of your options, you can determine the best path—whether that means selling, renovating, or keeping the property—that balances practicality with emotional considerations.

Finding the Right Support from Family Members

The stress of inheriting a property can feel isolating, but you don’t have to navigate it alone. If you are a personal representative managing an estate, or simply need support, Minneapolis has resources for homeowners facing this exact situation, from real estate agents and cash home buyers to estate planners and legal advisors. Setting up a dedicated checking account can help you manage property-related expenses, automate payments, and handle unexpected costs efficiently. Partnering with professionals who understand inherited properties can simplify the process and provide guidance tailored to your needs.

Cash home buyers, in particular, specialize in helping homeowners who need a fast, stress-free solution. They can provide fair offers, handle paperwork, and close on a timeline that works for you, allowing you to move forward without lingering worry. Estate attorneys or financial advisors can also provide insight into taxes, legal requirements, and options that maximize your financial outcome while minimizing complications. These professionals can also help address issues related to an existing mortgage, such as paying off the balance, dealing with liens, or managing mortgage-related costs during the estate settlement or property sale process.

Conclusion

Inheriting a property can feel like a burden rather than a gift, especially when it arrives unexpectedly or carries financial and emotional responsibilities. The stress of inheriting a property is silent but real, affecting your finances, your time, and your peace of mind. The significance of property ownership in the context of inheritance often brings emotional and cultural weight, as family traditions and memories are tied to the home. For Minneapolis homeowners, the combination of legal obligations, maintenance costs, and emotional ties can make managing an inherited property overwhelming.

Fortunately, solutions exist to ease this burden. Selling to a trusted cash home buyer offers a path to relief, providing certainty, speed, and the freedom to focus on what matters most. When considering selling, it’s important to evaluate the market appeal of the property—certain repairs or renovations can enhance its attractiveness to buyers and influence your selling outcome. Whether you choose to sell, rent, or keep the property, approaching the decision with awareness, professional guidance, and a clear plan can transform a stressful situation into a manageable one.

By addressing the practical and emotional aspects of inherited property head-on, you can reclaim control over your life and finances while honoring the memory of your loved one. The silent stress doesn’t have to take over—taking proactive steps can help turn an unexpected inheritance into an opportunity rather than a source of anxiety.

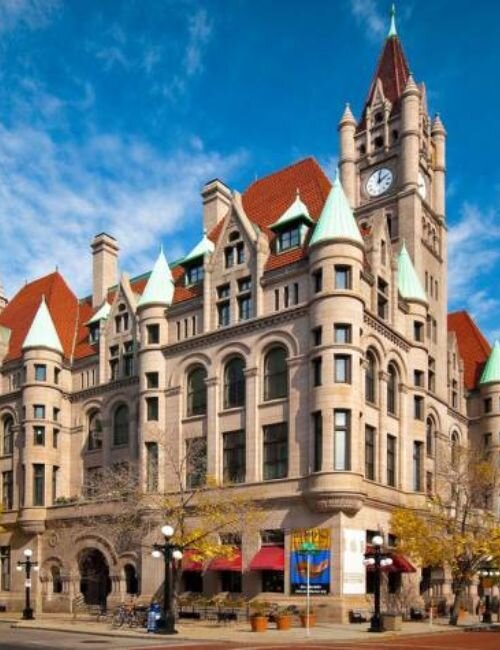

Helpful St. Paul Blog Articles

- Can Heir Property Be Sold in St. Paul, MN

- How Long After an Appraisal Can You Close in St. Paul, MN

- How to Sell a House in Bankruptcy in St. Paul, MN

- Selling My Parents’ House in St Paul, MN

- Sale Of A Rental Property in St. Paul, MN

- Selling A House With Termite Damage in St. Paul, MN

- Selling A House To A Family Member in St. Paul, MN

- Sell a House in St. Paul, MN, When Relocating

- Selling Home with Reverse Mortgage in Saint Paul, MN

- Selling Your House to a Relocation Company in Saint Paul, MN

- Can an Estate Administrator Sell Property in Saint Paul, MN

- How to Sell a House When You Are Behind on Payments in St. Paul, MN